Texas regional M&A update: H2 2020

M&A activity in Texas shows signs of rebound in H2 2020

Due to the COVID-19 pandemic, middle market M&A activity in Texas in 2020 was slightly lower than average. In the third quarter of 2020, M&A underwent a quicker recovery than other regions, likely driven by Texas’ leniency in pandemic-driven reopening policies.

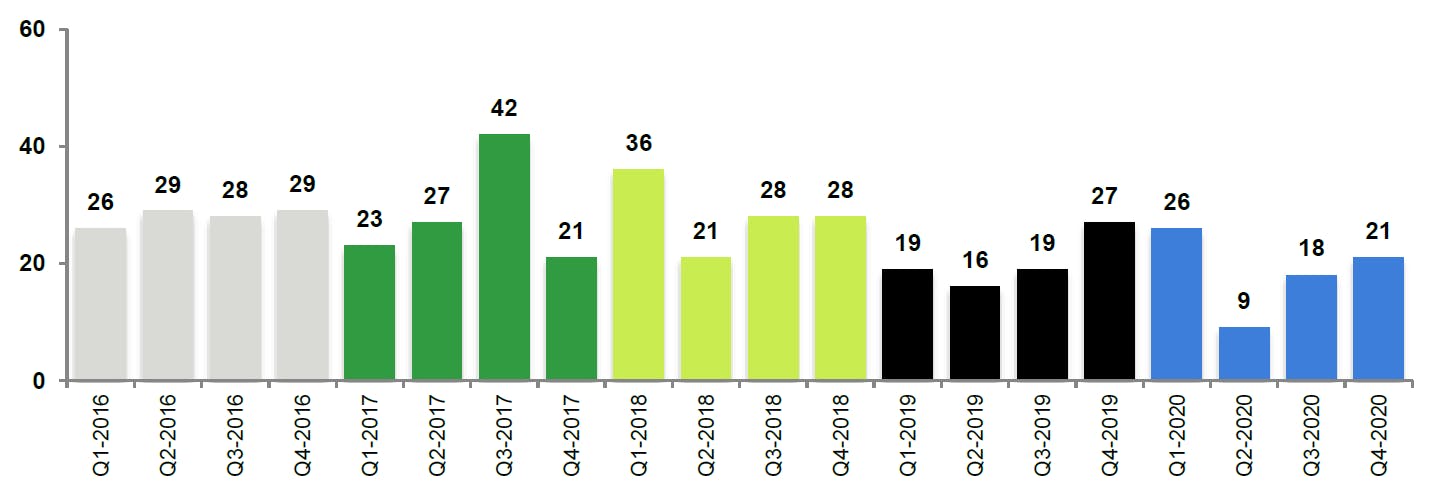

- A total of 39 transactions were announced in H2 2020, up slightly from 36 in H1 2020

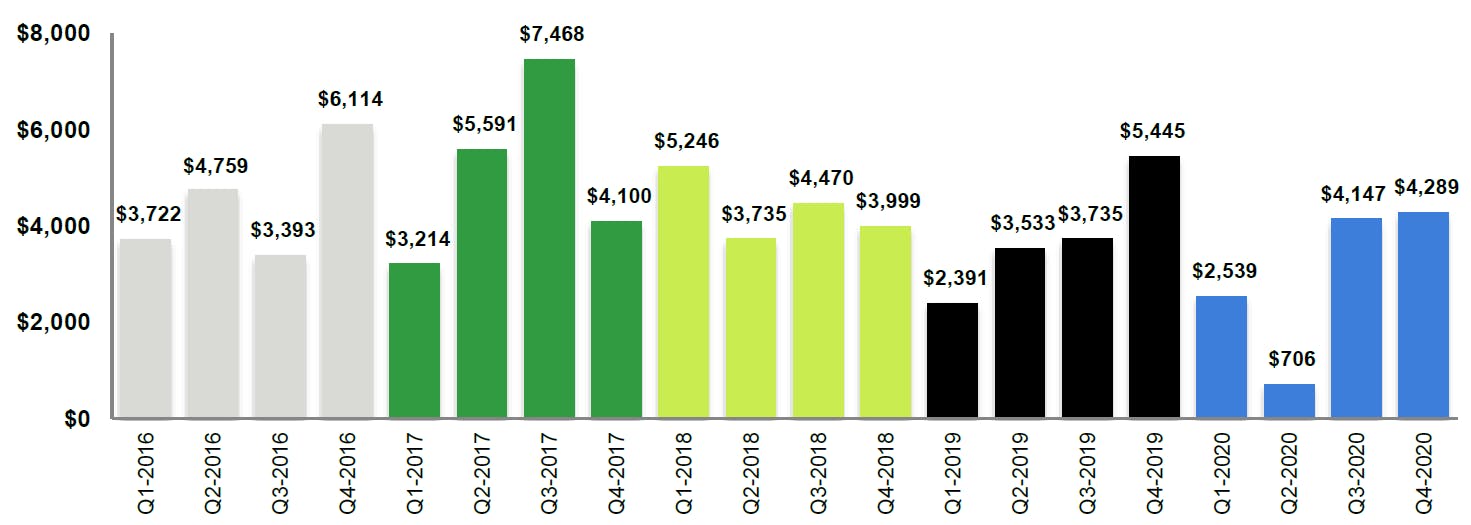

- The aggregate disclosed value of M&A transactions in H2 2020 totaled $8.4 billion, up from $3.2 billion in H1 2020, but a slight decrease from the $9.2 billion in H2 2019

- The second quarter of 2020 had the biggest negative impact on the year, as the nine announced transactions and average transaction value were both five-year lows

Texas middle market M&A transactions

Number of announced transactions (1)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 and $1000 million

Texas middle market M&A transactions

Aggregate value of announced transactions (1)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 and $1000 million

Strategic buyers continue to drive M&A activity

Based on the number of announced transactions, strategic buyers continued to be the most active buyer type in the second half of 2020. During H2, strategic buyers represented 87% of announced transactions.

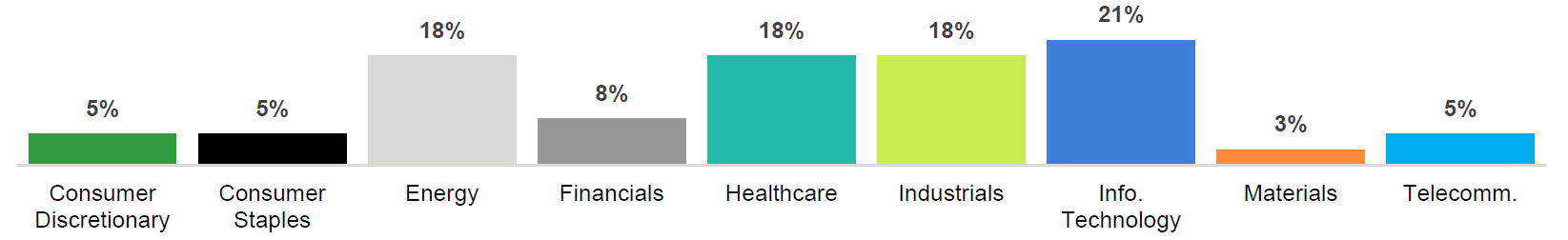

The information technology segment was the most active during the second half of 2020, accounting for 21% of M&A deals announced. The energy, healthcare and industrials segments accounted for the second, third and fourth largest categories for the period, with all contributing 18% of transaction volume, independently.

H2 2020 Texas middle market M&A transactions

Number of transactions by industry sector (1) (2)

Source: S&P Capital IQ

(1) Includes only transactions with disclosed enterprise value between $10 and $1000 million

(2) Percentages may not total 100% due to rounding