Food and beverage M&A update: H2 2020

Wellness and plant-based foods drive M&A

Fish that have never seen water. Meat that began as plants. After a quiet first half of the year, M&A activity in the food and beverage space came back during the last quarter of 2020, driven by several factors:

- Growing consumer demand for plant-based alternatives

- New plant-based analogs that go beyond the usual beef, pork and chicken

- A significant increase in snacking and meals prepared at home due to COVID-19

- The continuing trend of consumers to explore and embrace ethnic flavors and ingredients

- Increased demand for healthier, sustainable and environmentally friendly food choices

Deals up, dollars down

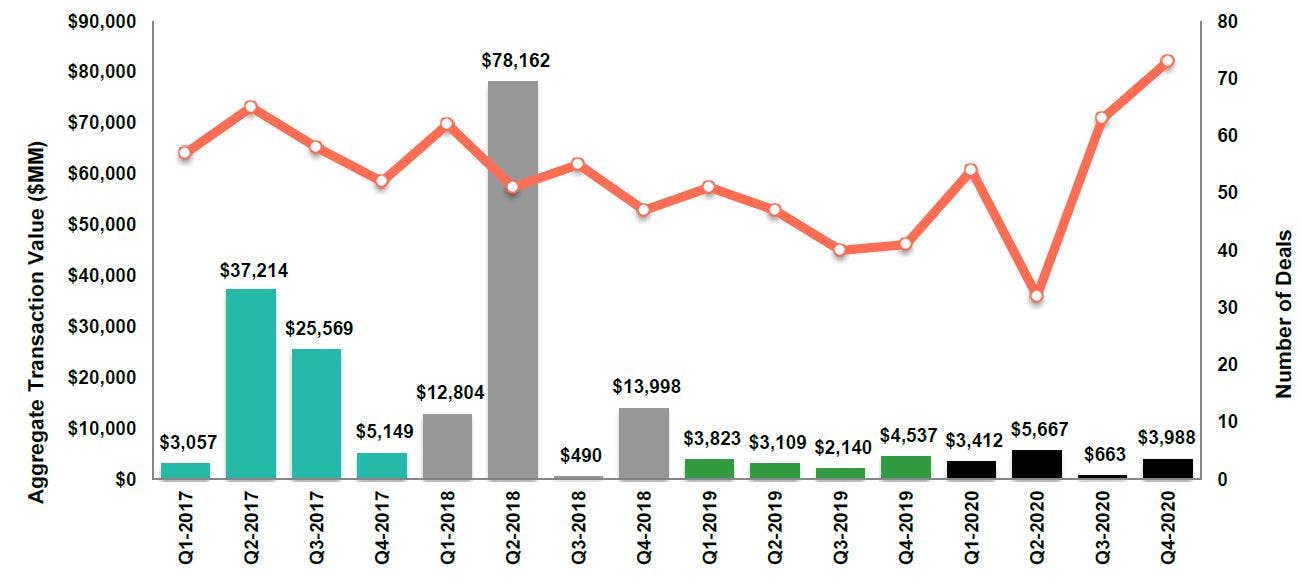

Quarterly U.S. food and beverage M&A activity for transactions closed

Aggregate transaction value and number of deals

Source: S&P Capital IQ and Baker Tilly Capital research (January 2021)

The first half of 2020 saw 86 closed M&A transactions, with Q2 seeing the steepest drop. During the second half of 2020, that number jumped to 136. The total value of all M&A transactions, however, dropped during the second half of the year, from $9.1 billion to $4.7 million. That drop is deceiving: The first half of the year saw one megadeal, PepsiCo’s $3.85 billion acquisition of Rockstar.

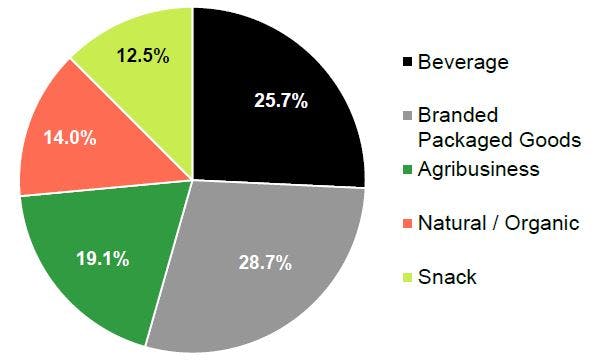

Snacking on M&A

About 33% of Americans reported that COVID-19 and work from home led to more frequent snacking, according to a Food and Health Survey by the International Food Information Council. That led to an appetite for M&A in the segment, with snack foods and beverages accounting for more than 54% of all M&A activity. With more Americans cooking from home, spices and sauces also saw a large upswing, with spice-maker McCormick’s $800 million acquisition of hot-sauce maker The Cholula Food Company a prime example.

H2 2020 M&A transactions by segment

Source: S&P Capital IQ and Baker Tilly Capital research (January 2021)

Dig into our report

For an in-depth look at M&A activity in the food and beverage industry, download a free copy of food and beverage M&A update: H2 2020. The report includes:

- M&A activity by market segment

- Investment information, including revenue, stock and forward-looking information

- Highlights of ethnic, specialty, health/wellness and other market segments

- Notable transactions closed during H2