Key considerations for companies envisaging SPACs

Special purpose acquisition companies (SPACs) are not new investment options, but their popularity has grown dramatically in recent years, as a vehicle for private entities to merge with an existing public shell or “Blank Check Company.” This type of merger is often more attractive than a traditional initial public offering due to the perceived ease of merging with a SPAC. Prominent underwriters and investors have also become more attracted to SPACs due to the relative speed in which deals are consummated. In 2020 alone, more than 50 SPACs were formed in the United States, raising more than $21.5 billion. As of August 2021, SPACs have raised more than $117 billion [1].

Private companies going through the SPAC process will need to consider the extensive process prior to the SPAC deal being finalized. These companies will be required to have their financial statements (typically two years of audited financial statements) audited under the standards set forth by the Public Company Accounting Oversight Board (PCAOB). Oftentimes these companies find that their current firm may not be independent under the PCAOB standards (prior independence under AICPA standards is much different). Management teams will also work alongside the SPAC’s management team in order to prepare the required proxy and legal registration statement in the Form S-4. There are several considerations during the initial planning phase that boards and management teams need to take into account prior to this process. For instance:

Negotiation and merger agreement

Have you identified the right SPAC? Has management discussed the future of the company? Selecting the right SPAC is the most critical of all the steps. When companies go through the process of going public, but they do not have an acquisition agreement in place with a SPAC, hiring various external resources and professional firms may be costly and the company can run the risk of the high cost of these resources affecting or possibly even ruining the SPAC deal and leaving the company with costs that it cannot recover. On average, a company will need to budget for a substantial increase in legal, accounting and consulting costs, which is discussed in detail below.

Quality of financial statement and supporting information

More often than not, companies that are not public and have not gone through the scrutiny of an external audit do not have a strong system in place as it relates to their financial statements, whether it’s a process around month-end close, financial disclosures, accounting memos, processes and procedures, internal controls or even a comprehensive accounting staff. When the initial planning phase of the SPAC process is occurring, companies will need to do a thorough internal examination of the overall quality of the company’s books and records. Management should assess the practicality of the company being able to achieve an unqualified audit opinion from a PCAOB audit. Should a company find any of the elements previously mentioned as a point of concern, the company should address these deficiencies first before hiring an external audit firm. These aspects will be highlighted by the external audit firm as significant deficiencies and could be the determining factor as to whether the company receives a Qualified, Unqualified or Adverse audit opinion.

Consideration of external professional services

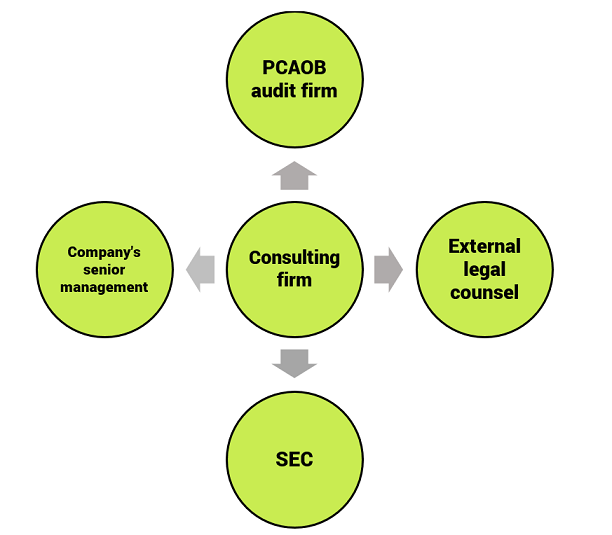

Raising capital can be an expensive endeavor. In addition to the hours the internal team will need to dedicate to creating, organizing and/or submitting various financial and accounting schedules (which will need to be considered a full-time job for a person within the organization), companies often will need to engage various professional service organizations to help complete the process.

First and foremost is the need to hire an independent audit firm to conduct a PCAOB standard audit. The PCAOB, formed in 2002, established and maintains the highest quality of auditing and related auditing services of public companies in order to protect investors and the public’s interest in the preparation of an informative, accurate and independent audit report.

External legal counsel with relevant expertise will be critical to the SPAC process. Legal counsel will facilitate the legal framework throughout the process of going public. Much of their work revolves around completing the proxy and legal statements on the Form S-4, which is required by the Securities and Exchange Commission (SEC). When completing a SPAC transaction, the required documentation that must be filed is the combined proxy and registration statement on the Form S-4.

The final firm to consider when going public is an advisory firm with significant audit experience to help facilitate the monumental task of making this process efficient and timely. This firm will serve as the project manager of the entire process, whether that means assisting the company in closing its books, creating schedules or serving as a liaison with the external audit firm while the audit is taking place. Advisory firms will also coordinate with the legal team on all fronts to ensure the inclusion of all financial information is properly presented and organized within the S-4 filing.

The SEC is the final regulatory body that will determine whether S-4 is effective for final filing. The SEC staff review process related to the SPAC deal follows the typical process of an IPO, in that the staff will review the filing report and issue comment letters, which almost always results in multiple rounds of comments.

When the SPAC deal is finally consummated, the company must file a current report on a Form 8-K within four business days announcing the deal; then the company has 68 days to submit a “super” 8k with the audited financial statements and associated pro formas. With a short turnaround time, it will be imperative to have much of the financial information prepared in advance of the final deal date.

Conclusion

The process of going through the SPAC is a labor intensive endeavor for any organization. It’s important to contemplate the various nuances outlined in this article before beginning this journey. However, once the organization has aligned itself and committed to a SPAC agreement, our firm can guide the company through the entire process and make it as painless as possible.

For more information on this topic, or to learn how Baker Tilly specialists can help, contact our team.

[1] “Proceeds of special purpose acquisition company (SPAC) IPOs in the United States” statista, Sept. 2021