Summary of upcoming changes to SSAP 26R and 43R – ‘Definition of Bond’

The Statutory Accounting Principles Working Group (SAPWG) began the “Investment Classification Project” in 2013 with the intent to undertake a comprehensive project to review the investment Statement of Accounting Principles (SSAPs). The purpose was to clarify definitions, scope, and the accounting methods and related reporting. The SAPWG met virtually in August 2021 to discuss the current status of the project and other topics. The IASA Xchange events held August 29 to September 1, 2021, in New Orleans included a presentation entitled “Upcoming Changes to: SSAP No. 26R & 43R - ‘Definition of Bond’ which also focused on the proposed definition. Baker Tilly insurance Value Architects™ attended these events to monitor regulatory updates. The following report summarizes the key milestones and ongoing discussion related to the definition of a bond as exposed by SAPWG for Bonds (SSAP No. 26R - Bonds) and Loan-Backed and Structured Securities (SSAP No. 43R - Loan-Backed and Structured Securities).

How did we get here?

SAPWG began the Investment Classification Project to consider investments that were outside of traditional “investment-type” definitions and specifically consider characteristics to ensure appropriate valuation and reporting. Since origination, the SAPWG has adopted substantive revisions to SSAP No. 26R - Bonds, SSAP No. 30R - Common Stock and SSAP No. 32R - Preferred Stock. Discussion of revisions to SSAP No. 43R - Loan-Backed and Structured Securities began in 2019 with a specific focus of underlying equity investments (Collateralized Fund Obligations (CFOs)). Since then, the discussion expanded to be a complete review of SSAP No. 43R under the investment classification project.

Key milestones in the project to date include:

August 2019: Exposed proposed revisions to exclude CFOs and similar structures that reflect underlying equity interests from SSAP No. 43R, as well as prevent equity assets from being repackaged as securitizations and reported as long-term bonds.

- January 2020: Directed a comprehensive project and the development of an issue paper to consider revisions to SSAP No. 43R.

- March 2020: Exposed preliminary issue paper for assessment.

- October 2020: Conducted hearing to receive industry comments on the exposed issue paper. Industry comments focused on two main themes:

- classification between SSAP No. 26R and SSAP No. 43R, and

- definition of asset-backed security (ABS). After discussion, SAPWG has taken a step back from the SSAP No. 26R vs SSAP No. 43R discussion and taken a more holistic principles-based approach to define a bond to be reported on Schedule D-1 (whether 26R or 43R). Exposed draft principles as a starting point.

- May 2021: Exposed the proposed Schedule D-1 definition. Exposure provided principle concepts for the bond definition and noted that discussions and developments are still required for investments not falling under the proposed definition in addition to transition guidance.

- August 2021: Voted to affirm the direction of the exposed principles-based bond concepts and directed NAIC staff to utilize those concepts to develop an issue paper and proposed SSAP revisions. All elements of the proposal, and the reflection of those concepts in statutory accounting guidance, is subject to continued discussion.

Why the potential change?

Several factors have led to increased innovation in insurers’ investment portfolios. Specifically, the low-interest rate environment has increased pressure to seek higher yields through investment vehicles often including unique features. There has been an increasing relationship between insurers and asset originators which has increased insurers’ access to more innovative asset types and structures. These asset types often involve the securitization of an increasing variety of collateral, which transforms the underlying collateral into a bond. This evolution has benefits to policyholders through improved crediting rates, but also challenges regulators to understand the risks involved in insurers’ investment portfolios.

The current bond definition allows any security that represents a creditor relationship to qualify for bond reporting (either SSAP No. 26R or SSAP No. 43R) with the focus of investment classification on legal form, rather than substance. As a result, the opportunity exists to report many assets as bonds by acquiring it through a special purpose vehicle (SPV) as a debt instrument from the SPV. The insurer may or may not be in a different economic position as if they held the underlying assets directly. In addition to this opportunity, there is also a Risk Based Capital (RBC) incentive to classify otherwise non-qualifying assets as bonds. Underlying assets may be inadmissible or may receive worse RBC charges (equities) if held directly on the insurer’s balance sheet. Regulators currently have little transparency into whether assets classified as bonds incorporate risks that do not reflect traditional bond risk.

Goals for principles-based approach

By defining principles, the updated framework is intended to accommodate an increasingly innovative bond market since the framework will focus on substance over form. While principles are inherently subjective, they provide a framework for evaluating the substance of a structure. The combination of the principles and increased transparency gives regulators the necessary tools to understand the risks present in insurers’ investment portfolios. Additionally, under the revised definitions, compliance is the responsibility of the reporting entity, but conclusions should be supported by documentation when requested by auditors or regulators.

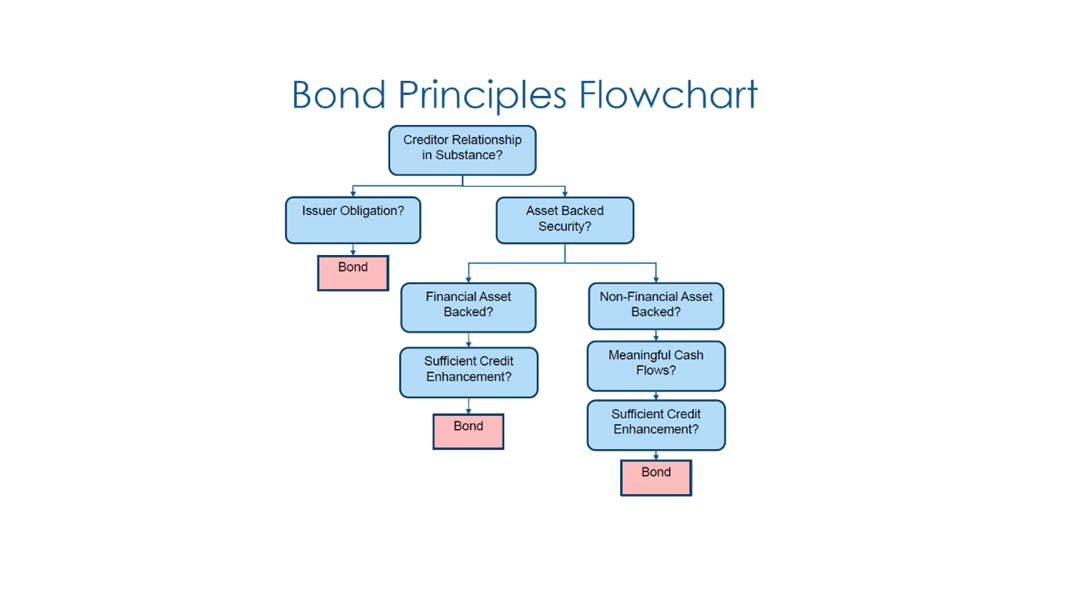

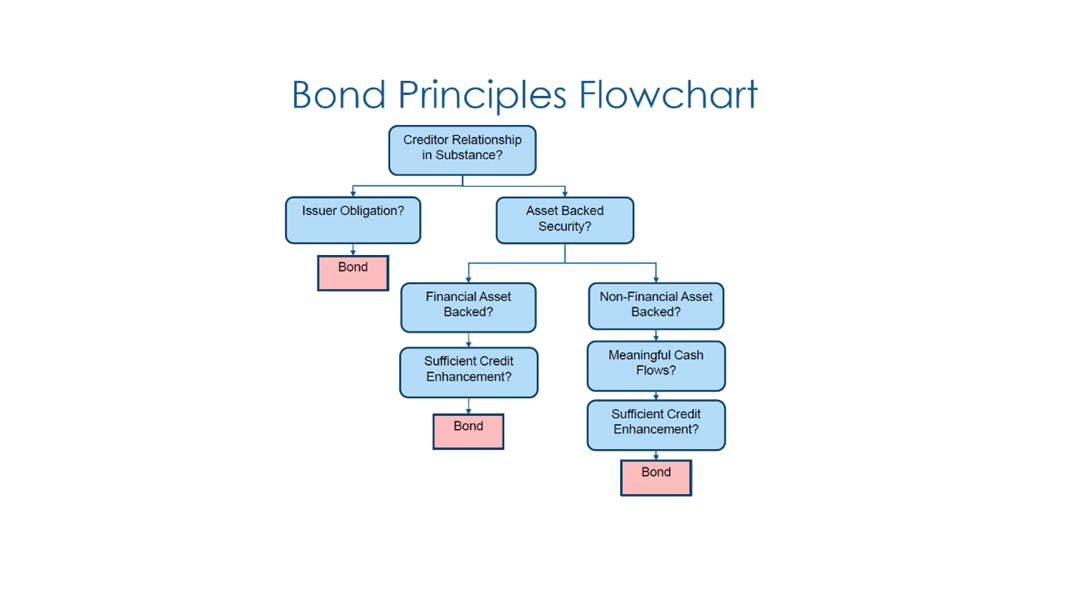

The flowchart above, taken from Kevin Clark’s presentation at the IASA Xchange event, is designed to walk through the proposed definition of a “bond”. It is important to note that the current exposure provides principle concepts for the bond definition which are included in the flow chart. Discussions and developments are still required on the following aspects:

- Proposal to improve transparency and reporting for Schedule D-1 items. This is planned to revise the existing reporting lines / categories and include more granular / descriptive reporting lines as well as a potential sub-schedule to identify items that have underlying equity risk or that do not self-liquidate.

- Inclusion of actual revisions to the SSAPs to incorporate the bond definition as well as the development and adoption of an issue paper to document the discussions and revisions in developing the bond definition.

- Development of accounting and reporting guidance for investments that do not fit the scope of SSAP No. 48 - Joint Ventures, Partnerships and Limited Liability Companies and that do not qualify under the bond definition.

- Consideration of transition guidance.

Creditor relationship in substance

The first consideration in the principles-based flowchart is that under the proposed bond definition, a bond represents a creditor relationship with a fixed payment schedule. The investment must represent a creditor relationship in substance, not just legal form, to be classified as a bond. The proposed definition specifies that investments with equity-like characteristics or that represent ownership interests in substance, do not meet the definition.

Issuer obligations or asset-backed securities

In addition to a creditor relationship, investments meeting the bond definition are either issuer obligations or asset-backed securities (ABS). Issuer obligations are issued by operating entities and the repayment of the instrument is supported by the general creditworthiness of an operating entity. New examples proposed to be named include:

- project finance bonds issued by operating entities

- equipment trust certificates (ETCs), enhanced equipment trust certificates (EETCs) and credit tenant loans (CTLs) when payment is fully supported by a lease to an operating entity

- bonds issued by REITs or similar property trusts

- bonds issued by business development corporations, closed-end funds or similar operating entities registered under the 1940 Act

ABS are issued by entities that have a primary purpose of raising debt capital backed by collateral that provides the cash flows to service the debt. The interpretation of what represents an issuer obligation has been a significant item of discussion and there is significant diversity in interpretation in practice currently. The principles attempt to improve clarity.

Financial ABS or non-financial ABS

Under the proposed definition, ABS are investments that are either backed by financial assets or by cash generating non-financial assets. The proposal uses the current SSAP 103R – Transfers and Servicing of Financial Assets and Extinguishments of Liabilities definition for financial assets which is defined as cash, evidence of an ownership interest in an entity, or a contract that conveys to one entity a right (a) to receive cash or another financial instrument from a second entity or (b) to exchange other financial instruments on potentially favorable terms with a second entity. Financial assets do not include assets for which the realization of the benefits of the assets depends on the completion of a performance obligation (e.g. leases, mortgage servicing rights, etc,).

When a performance obligation exists, the asset represents a non-financial asset, or a means though which non-financial assets produce cash flows until the performance obligation has been satisfied. Cash generating non-financial ABS are assets that are expected to generate a meaningful source of cash flows for repayment of the bond through use, licensing, leasing, servicing, or management fees to generate cash flows. Non-financial assets must be expected to generate meaningful cash flows to service the debt, other than through the sale or refinancing of assets, in order to meet the definition of a bond. Reliance on cash flows from the sale or refinancing of does not preclude a bond from being classified as ABS as long as the meaningful cash flow requirement is met.

Determining meaningful cash flows is specific to each transaction, determined at origination, and should consider various factors, including but not limited to the following:

- Price volatility in the principal market for the underlying collateral

- Liquidity in the principal market for the underlying collateral

- Diversification characteristics of the underlying collateral (i.e., types of collateral, geographic locations, sources of cash flows within the structure, etc.)

- Overcollateralization of the underlying collateral relative to the debt obligation

- Variability of cash flows, from sources other than sale or refinancing, expected to be generated from the underlying collateral

Application of this principle requires judgment and is the responsibility of the reporting entity. There are no “bright line” cut-offs. The exposed principles include a “practical expedient” to provide a threshold of residual asset risk under which cash flows would be presumed to be meaningful (i.e. less than 50% of original principal).

Sufficient credit enhancement

The proposed definition requires the holder of the ABS to be in a different economic position than owning the collateral directly. If the holder would be in the same economic position if they held the underlying collateral directly, it is not an ABS and ultimately not a bond. In order to support that an insurer is in a different economic position, there must be sufficient credit enhancement, through overcollateralization / subordination or other form of guarantee or recourse, to support that the underlying collateral risks have been recharacterized to bond risk.

Sufficient credit enhancement refers to a level of subordination that is expected to absorb losses commensurate with other debt investments of similar quality over a range of stress scenarios. The sufficiency threshold is specific to each debt instrument at origination. Losses are those a market participant would estimate and considers historical losses (including loss recoveries) on similar collateral, current conditions, reasonable and supportable forecasts, and prepayment assumptions associated with the collateral. Excluded from the estimate of losses are historical gains on similar collateral and expected market appreciation.

Key bond definition takeaways

Based on the proposed definition, a significant majority of insurers’ portfolios will likely have minimal impacts. Holders of only traditional issuer obligations (corporates, treasuries, municipal securities, etc.) will likely have no impact. Holders of traditional, widely marketed securitizations of financial assets (RMBS, CMBS, CLO) will use market validation to support sufficient credit enhancement. Assets requiring additional analysis will include:

- Assets that are collateralized by underlying equity investments

- Assets that are collateralized by non-financial assets that rely heavily on cash flows that are not contractually secured

- Asset with other unique or complex structures, particularly when 3rd party market validation is not present to help support conclusions

SAPWG has received various comments for the proposed definition and is working to develop revisions to guidance for the accounting treatment of bonds reported on Schedule D-1 and investments which do not meet the proposed bond definition. All elements of the proposed bond definition, and the reflection of those concepts in statutory accounting guidance, are subject to continued discussion. Revised guidance for Schedule D-1 investment classification will not be considered authoritative statutory guidance until the specific effective date detailed in adopted authoritative SSAPs. It should be clearly noted that wide-spread grandfather provisions are not expected. SAPWG projects that the earliest the entire package of SSAP revisions and blanks revisions could be effective is January 1, 2024.

For more information on these topics, or to learn how Baker Tilly’s insurance industry Value Architects™ can help, contact our team.

Reference:

Clark, Kevin. Upcoming Changes to: SSAP No. 26R and 43R – ‘Definition of Bond’. 2020. Kevin Clark. August 29 - September 1, 2021, New Orleans, LA. Slide 30.