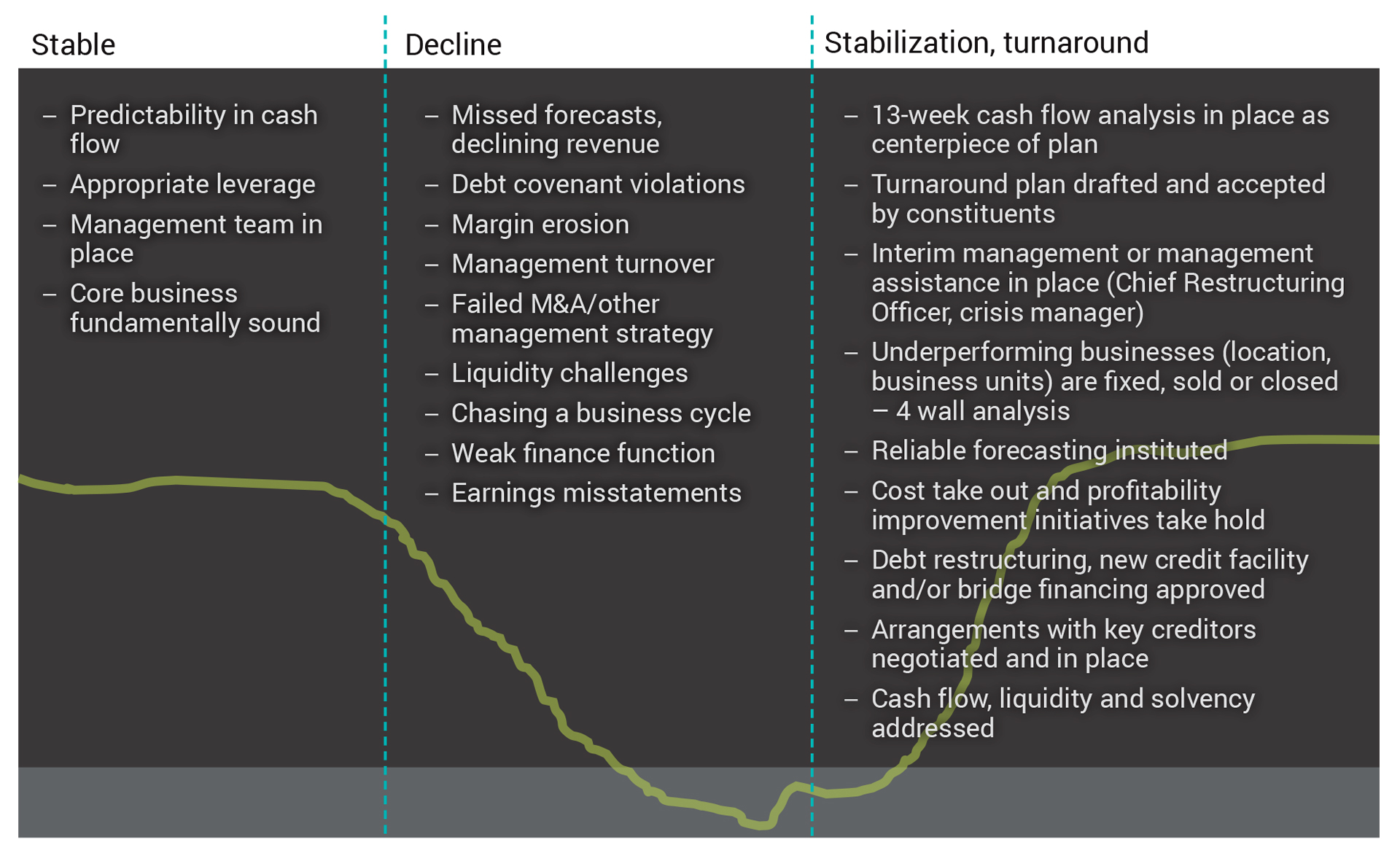

Like any significant and complex problem, it is best to break the issues down into discrete tasks and focuses. One of the most important elements of a successful turnaround is speed. The quick development of a plan, executed vigorously, is always preferable over waiting for the perfect plan. Our renewal services are grouped into four stages: 1) 13-week cash flow analysis, 2) assess team, 3) draft a plan, and 4) assist with plan implementation as well as financing referrals, if necessary.

13-week cash flow analysis – This analysis and tool is at the heart of any turnaround plan. Start assembling this analysis immediately.

Assess team – Assess whether the organization has the right internal skill sets to execute and augment where necessary. Consider the need to bring in outside resources (e.g., crisis manager, interim CFO, financial resources, turnaround specialists).

Drafting a plan – Formulate a plan and write it down. The document will serve multiple purposes and support discussions with boards, lenders, investors and management. Consider what can be fixed, sold or requires closure, along with what operational or staff changes need to be made quickly. Develop appropriate forecasts to accompany the plan.

Financing referrals – Most turnarounds require either additional financing or modifications to existing terms. The 13-week analysis, turnaround plan, financial forecasts and sources and uses are the key documents required to support a financing request that can be appropriately underwritten.