Asset Liability Management

Providing a customized approach to compliance, internal audit and model validation to meet your asset liability management (ALM) needs

Our solutions

Having an up-to-date and integrated asset liability management (ALM) system is essential to managing your institution’s interest rate risk. Asset liability management plays a vital role in weaving together the distinct business lines in financial institutions. The management of both the liquidity and financial position are crucial to the existence of a financial institution and sustenance of its day-to-day operations. Accurately managing assets and liabilities, however, can be a significant challenge.

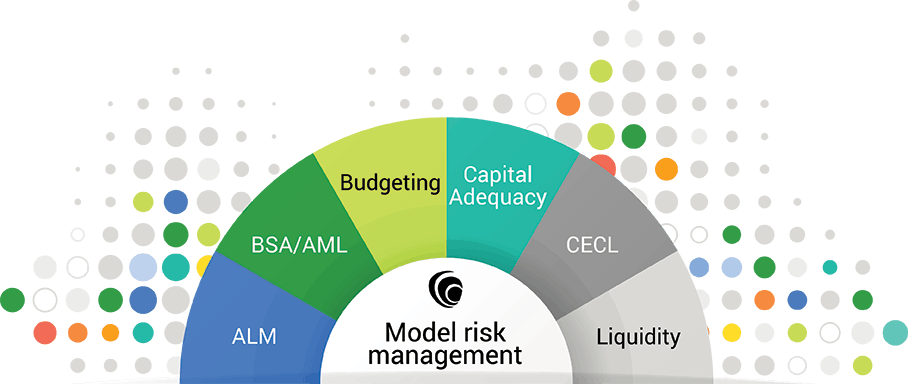

Baker Tilly has extensive experience helping financial institution clients with all areas of risk, including interest rates, credit and liquidity — we can be a single source for all your ALM needs. In addition to our full range of ALM services, our CECL solutions and model risk management services are customized to fit the different needs of each client. These various compliance needs use the same source of data, and our team can leverage that data across compliance requirements for a more efficient and accurate outcome — delivering you value beyond compliance.

Model risk management

- Ongoing modeling

- Model validation

- Stress testing

ALM modeling is crucial to help make informed strategic decisions, so it is important that you have confidence in your ALM inputs, modeling and outputs.

Our range of modeling solutions include:

- Outsourced

- Scenario

- Liquidity

Whether you need a complete model replication to gain assurance that outputs are accurate or help to address specific issues, Baker Tilly provides that range of validation services. Our ALM specialists will satisfy regulatory requirements as well as provide you with additional value to help your institution make better business decisions.

Our validations can include:

- Full model replication and testing — Baker Tilly completes model validation to conform to the guidance Interagency Statement on Model Risk Management for Supervisory Guidance on Model Risk Management that was issued on April 9, 2021

- Governance and policy documentation, including, data inputs, data assumptions, model methodology and testing

Stress testing your balance sheet through your ALM model is crucial to better understand the impacts to your institution from various scenarios that may occur.

Our stress testing includes:

- Customizable portfolio stress-testing relating to forecasting under varying economic conditions

- Custom scenarios with institution management to determine ultimate impacts to ALM profile

- Back testing

Ongoing modeling

ALM modeling is crucial to help make informed strategic decisions, so it is important that you have confidence in your ALM inputs, modeling and outputs.

Our range of modeling solutions include:

- Outsourced

- Scenario

- Liquidity

Model validation

Whether you need a complete model replication to gain assurance that outputs are accurate or help to address specific issues, Baker Tilly provides that range of validation services. Our ALM specialists will satisfy regulatory requirements as well as provide you with additional value to help your institution make better business decisions.

Our validations can include:

- Full model replication and testing — Baker Tilly completes model validation to conform to the guidance Interagency Statement on Model Risk Management for Supervisory Guidance on Model Risk Management that was issued on April 9, 2021

- Governance and policy documentation, including, data inputs, data assumptions, model methodology and testing

Stress testing

Stress testing your balance sheet through your ALM model is crucial to better understand the impacts to your institution from various scenarios that may occur.

Our stress testing includes:

- Customizable portfolio stress-testing relating to forecasting under varying economic conditions

- Custom scenarios with institution management to determine ultimate impacts to ALM profile

- Back testing

Related solutions

Compliance+

Bringing you value beyond compliance

CECL Solutions

Solving your compliance needs - with an eye to the future. CECL modeling, validation, implementation and methodology expertise can all be found at Baker Tilly.

Mortgage Center of Excellence

The industry hub for compliance, risk management, innovation and more