Utility financial process automation: Greater efficiencies and workforce redeployment

Why automate?

Like eating kale salad for good health and relying on a smart speaker as a virtual assistant, it may also be said that automating financial business processes for utilities will be revolutionary. As the quality of opportunities for automation become available to utilities of all sizes, the question is “when” not “if” this revolution will take place.

“What should we automate?” is unique to each utility based on factors such as customer service needs, utility size, services offered and current quality of internal best practices. And like any business strategy, an automation strategy needs to be thought out, discussed and detailed. Questions related to long-term planning and implications for other strategies also need to be well developed.

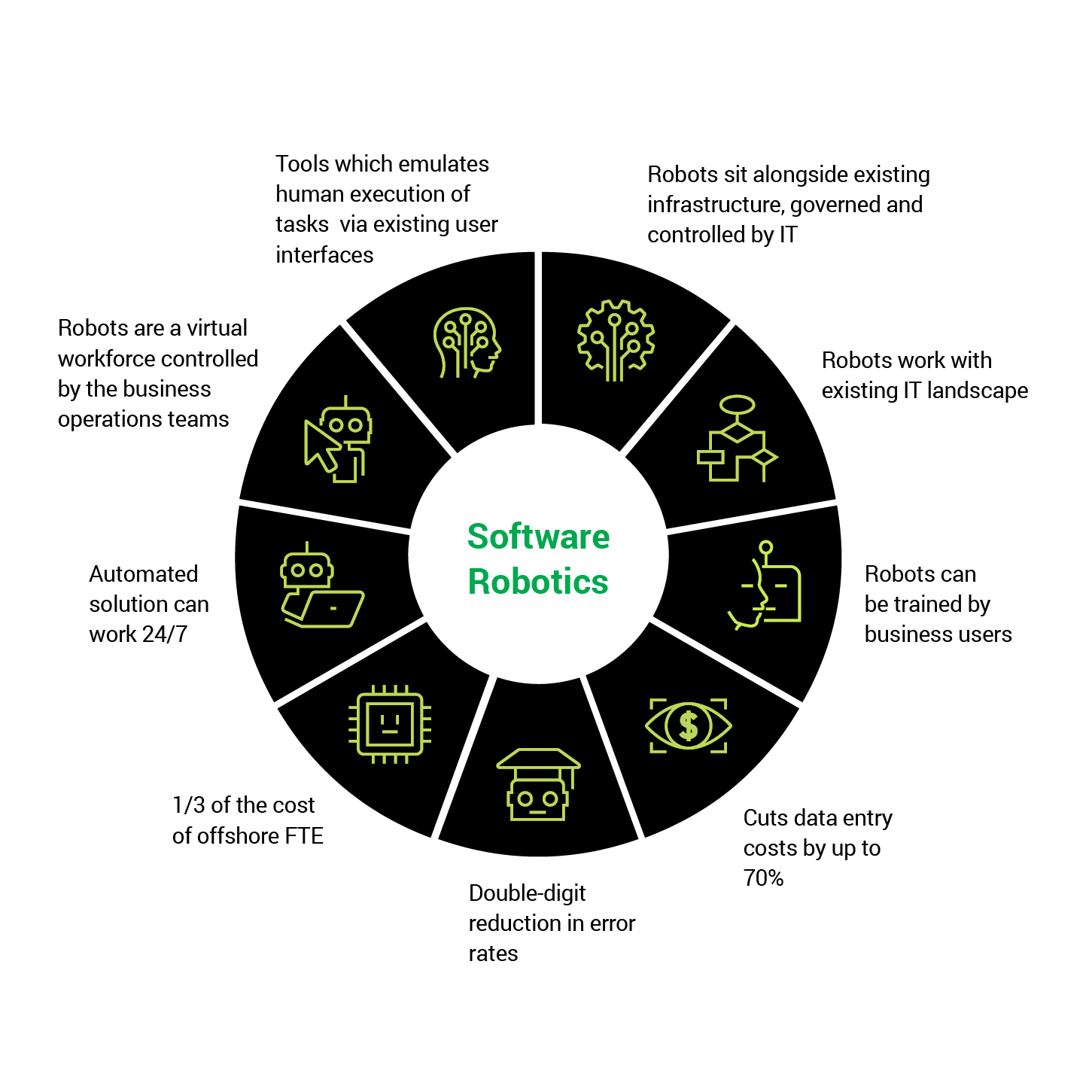

As illustrated in the graphic below, automation creates benefits through reduced data entry costs, less errors, labor savings and greater transactional efficiencies.

Potential financial process automation areas

Ask your smart speaker “Which processes should we automate?” and it will reply to the effect of “I do not know the answer to that question.” While your smart speaker may not want any competition, potential areas of automation for your utility include:

- Accounts payable invoice routing, approval and payment

- Purchase orders

- Time-keeping

- Materials management ordering

- On-line customer payments

- Self-service customer kiosks

- Contract analysis to determine lease components

- Employee expense reporting and payment

- Speed of financial reporting

- Real-time integration of the utility construction process

Future applications will include real-time customer invoicing, billings and collection, general accounting, internal and external financial reporting, budgeting and others.

RPA for better business practices

Robotic process automation (RPA) may sound like an exotic tool only affordable by large utilities, but that’s not so! RPA is key to automating your utility’s financial business processes. This tool is dependent on detailing step-by-step processes in business process maps. It then programs those detailed steps in software that completes the process from initiation to approval. Furthermore, any RPA solution may be integrated with a "decision step," allowing for human intervention/review in the newly automated process.

RPA approach

A recent Baker Tilly insight, based on actual RPA client implementation projects, details a five-step approach to a successful RPA launch for a specific business process. The steps include:

- Project preparation

- Use case identification and automation potential

- Business case development

- RPA preparation

- RPA implementation

Leveraging internal resources

Although your utility may not have personnel with RPA software development skills, to get the ball rolling on your RPA project, you may be able to leverage existing internal resources such as:

- A utility project champion

- Initial process maps of key financial business processes under consideration for automation (as you delve further into your RPA project, more detailed process maps may be needed)

- Detailed policies and procedures for key financial processes

- Utility team members able to train staff in new processes prior to implementation

Find out more

Automating financial business processes through robotic process automation (RPA) will revolutionize how utilities control costs, redeploy workers and increase other efficiencies. A consulting firm that specializes in utilities can help you explore this exciting phase of utility financial processes.

For more information on this topic, or to learn how Baker Tilly energy and utility specialists can help, contact our team.