SEC ruling: summary of amendments to filer definitions and Sarbanes-Oxley (SOX) impacts

On May 9, 2019, the U.S. Securities and Exchange Commission (SEC) issued a proposed rule to amend the definitions of “accelerated filer” and “large accelerated filer”. On March 12, 2020, the SEC issued the final ruling on this proposal, Amendments to the Accelerated Filer and Large Accelerated Filer Definitions. According to the SEC, the amendments will:

- Exclude from the accelerated and large accelerated filer definitions an issuer that is eligible to be a smaller reporting company and had annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available;

- Exclude business development companies from the accelerated and large accelerated filer definitions in analogous circumstances;

- Increase the transition thresholds for an accelerated and a large accelerated filer becoming a non-accelerated filer from $50 million to $60 million and for exiting large accelerated filer status from $500 million to $560 million;

- Add a revenue test to the transition thresholds for exiting both accelerated and large accelerated filer status; and

- Add a check box to the cover pages of annual reports on Forms 10-K, 20-F, and 40-F to indicate whether an internal control over financial reporting (ICFR) auditor attestation is included in the filing.

As a result of the amendments, certain low revenue filers will remain obligated to provide a report by management assessing the effectiveness of the company’s ICFR, but will not require an attestation report from the company’s independent auditor assessing the effectiveness of the company’s ICFR.

The final ruling is available on the SEC’s website. The amendments that were established as part of the ruling issuance are summarized below.

Amended smaller reporting company definition

As part of the ruling, the SEC amended the smaller reporting company (SRC) definition to allow issuers to use either the public float or SRC revenue test to determine SRC status.

Further, the SEC increased the threshold in the public float test for an issuer to initially qualify as an SRC to less than $250 million (from less than $75 million). The SEC also expanded the revenue test to further amend the definition of SRCs to include registrants with annual revenues of less than $100 million for the previous year with either no public float or a public float of less than $700 million.

In conjunction with these amendments, the SEC also revised the accelerated filer and large accelerated filer definitions in Rule 12b-2 to remove the condition that, for an issuer to be an accelerated filer or a large accelerated filer, it must not be eligible to use the SRC accommodations. One result of these amendments is that some issuers now are categorized as both SRCs and accelerated or large accelerated filers.

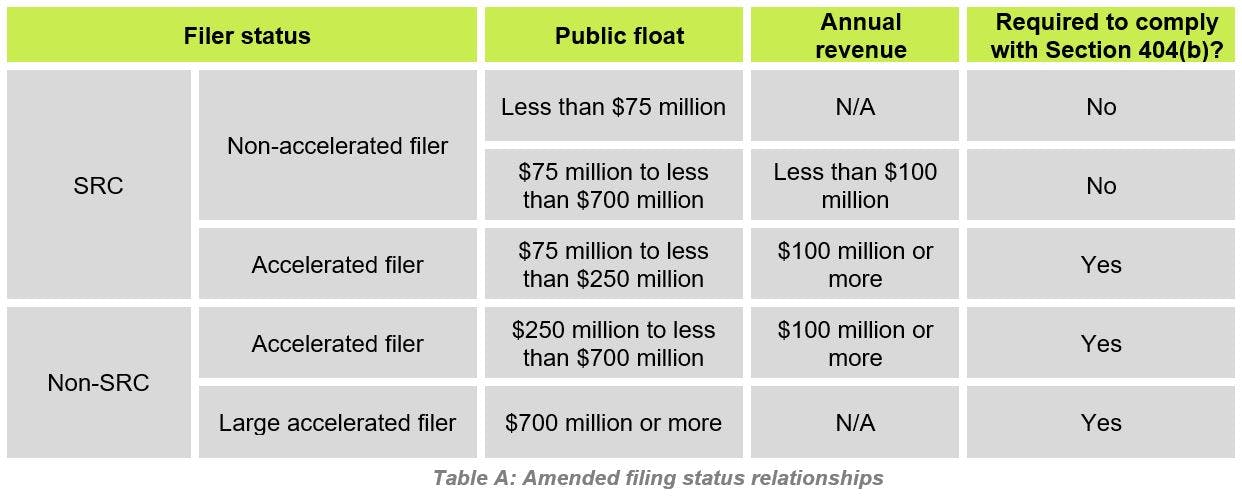

Under the final amendments, issuers that are eligible to be an SRC and meet the SRC revenue test will not be required to comply with the internal control over financial reporting (ICFR) auditor attestation requirement (SOX Section 404(b)).

Relationship between SRCs and non-accelerated and accelerated filers

The SEC ultimately elected to refrain from increasing the public float threshold for non-accelerated filers in order to fully align the non-accelerated filer definition with the SRC definition. Instead, the final amendments noted that some, but not all, SRCs would become non-accelerated filers. The ruling also reiterated that accelerated filers and large accelerated filers other than emerging growth companies (EGCs), registered investment companies (RICs) and asset backed securities (ABS) issuers require compliance under SOX Section 404(b).

There is no change to management’s responsibilities to assess ICFR under Section 404(a) of the Sarbanes-Oxley Act. For example, the issuers’ principal executive and financial officers must continue to certify that, among other things, they are responsible (1) for establishing and maintaining an adequate control structure and procedures for financial reporting and (2) have evaluated and reported on the effectiveness of the company’s disclosure controls and procedures.

Table A summarizes the amended filing criteria in the context of SOX Section 404(b) requirements, and the amended filing status relationships between SRCs and non-accelerated and accelerated filers:

Effect on business development companies (BDC)

The resulting amendments declared that a BDC’s investment income is now classified as the BDC’s revenue, as defined in Rule 6-07.1 of Regulation S-X. The SEC determined that BDCs would continue to be ineligible to qualify as SRCs, but may qualify for exclusion from both the large and large accelerated filer definitions if the BDC meets the requirements of the SRC revenue test using their annual investment income as the measure of annual revenue.

Therefore, a BDC will be excluded from the accelerated and large accelerated filer definitions in Rule 12b-2 if the BDC:

- Has a public float of $75 million or more, but less than $700 million; and

- Has investment income of less than $100 million.

- The ruling also stated that BDCs are subject to the same transition provisions for accelerated filer and large accelerated filing status that apply to other issuers under the amendments, except that the amendments’ BDC-specific “revenue” definition will apply to these transition provisions as well.

Check box indicating ICFR auditor attestation

Prior to the amendment ruling, disclosure of the ICFR auditor attestation was solely required within the auditor’s report on the financial statements and management’s annual report on ICFR. Under the new ruling, issuers will be required to include a check box on the filing cover pages indicating whether an ICFR auditor attestation is included in the filing for any annual reports filed on or after the final amendments’ effective date.

The SEC determined that this amendment will be a more prominent and easily accessible disclosure of this information, while imposing only minimal burdens on issuers.

Public float transition thresholds and the SRC revenue test

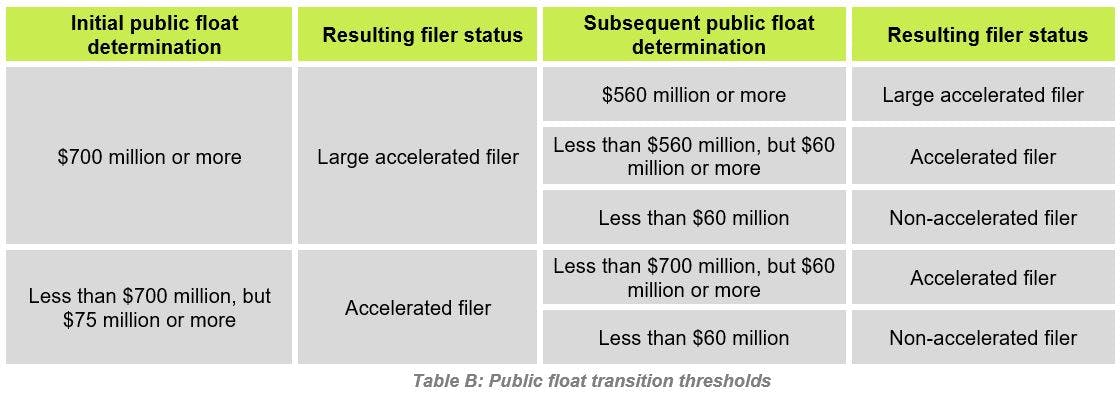

Prior to the amendments, the public float threshold for an accelerated and large accelerated filer to become a non-accelerated filer was $50 million and the public float transition threshold for a large accelerated filer to lose its large accelerated filer status was $500 million.

As the SEC believed these thresholds resulted in more issuers being classified as an accelerated or large accelerated filer than originally intended, the final amendments revise the public float transition threshold (as of the last business day of its second fiscal quarter) for accelerated and large accelerated filers to become a non-accelerated filer from $50 million to $60 million and revise the public float transition threshold for a large accelerated filer to lose its large accelerated filer status from $500 million to $560 million. Table B further summarizes the amended public float transition thresholds.

The final amendments also add the SRC revenue test (in the most recent fiscal year for which audited financial statements are available) to the transition threshold for accelerated and large accelerated filers.

Steps to take now

Issuers:

- Discuss the amendments and revised definitions with the independent auditor to determine potential impacts to the company, including the scope of future audits.

- Review the definitions and transition provisions carefully, as these may revise the organization’s reporting requirements.

- If an issuer is exempt from the auditor attestation over ICFR:

a. Discuss this impact with the organization’s auditor. Maintaining an external auditor attestation over ICFR, even if not mandated under the final ruling, may be worth considering as this could have additional benefits for the company.

b. Consider having management or internal audit perform ICFR testing with similar rigor as previously performed by the auditors. Recognizing issuers not subject to the ICFR auditor attestation requirement may have less resources or personnel, the lack of focus on ICFR may increase the risk of fraud, financial statement restatements or misstatements, unidentified material weaknesses or an ineffective control environment.

Auditors:

- Communicate the potential impact of the amended definition with issuer audit clients.

- Ensure that clients are aware of the related transition provisions and the potential impacts to future audits and financial reporting.

Audit committees:

- Ask management to assess the organization’s filer status to determine if the amendments to filer definitions and other factors impact the company’s requirement of auditor attestation over ICFR.

- Review the definitions and transition provisions carefully, as these may revise the organization’s reporting requirements.

The final amendments per the SEC ruling become effective April 27, 2020, and will apply to annual report filings due on or after the effective date, even if that annual report is for a fiscal year ending before the effective date.

To better understand the impact of this ruling on your organization, contact one of our specialists.

Asset backed securities (ABS): Financial securities backed by assets such as credit card receivables, home-equity loans and auto loans. An ABS issuer is an issuer that sells ABSs.

Business development company (BDC): A domestic closed-end company that (1) operates for the purpose of making investments in certain securities specified in Section 55(a) of the 1940 Act and, with limited exceptions, makes available “significant managerial assistance” with respect to the issuers of such securities, and (2) has elected business development company status.

Emerging growth company (EGC): A company with total annual gross revenues of less than $1.07 billion during the company’s most recently completed fiscal year and, as of Dec. 8, 2011, had not sold common equity securities under a registration statement. A company may continue to be classified as an emerging growth company for the first five fiscal years after it completes an IPO, unless one of the following occurs:

- The company’s total annual gross revenues are $1.07 billion or more

- The company issued more than $1 billion in non-convertible debt in the past three years or

- The company becomes a “large accelerated filer,” as defined in Exchange Act Rule 12b-2

Public float: The aggregate number of a company’s outstanding shares available for trading by public investors, multiplied by the current sale price of the shares.

Registered investment company (RIC): A company that is registered and regulated under the Investment Company Act of 1940.

SOX section 404(a): Requires registrants to provide a report by management assessing the effectiveness of the company's ICFR beginning with the second annual report after becoming a public company.

SOX section 404(b): Requires an attestation report from the company’s independent public accountant assessing the effectiveness of the company’s ICFR.