M&A activity in Pennsylvania continues to bounce back

After a healthy rebound in 2020 and the first half of 2021, the Philadelphia and Central Pennsylvania region continued its upswing in the second half of 2021. This healthy market recovery is largely attributed to:

- Performance surpassing the previous year’s benchmarks in closed transactions and deal volume

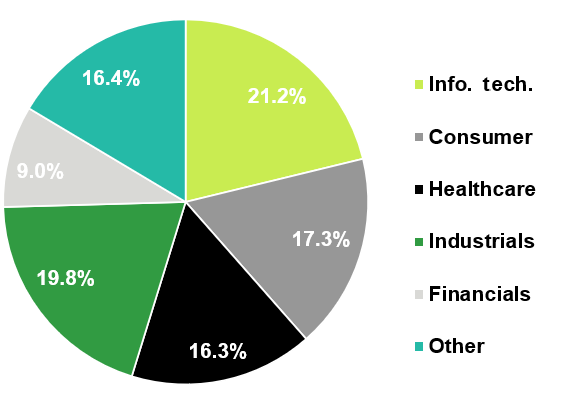

- Shifting focus into the information technology sector

Surpassing benchmarks in H2 2021

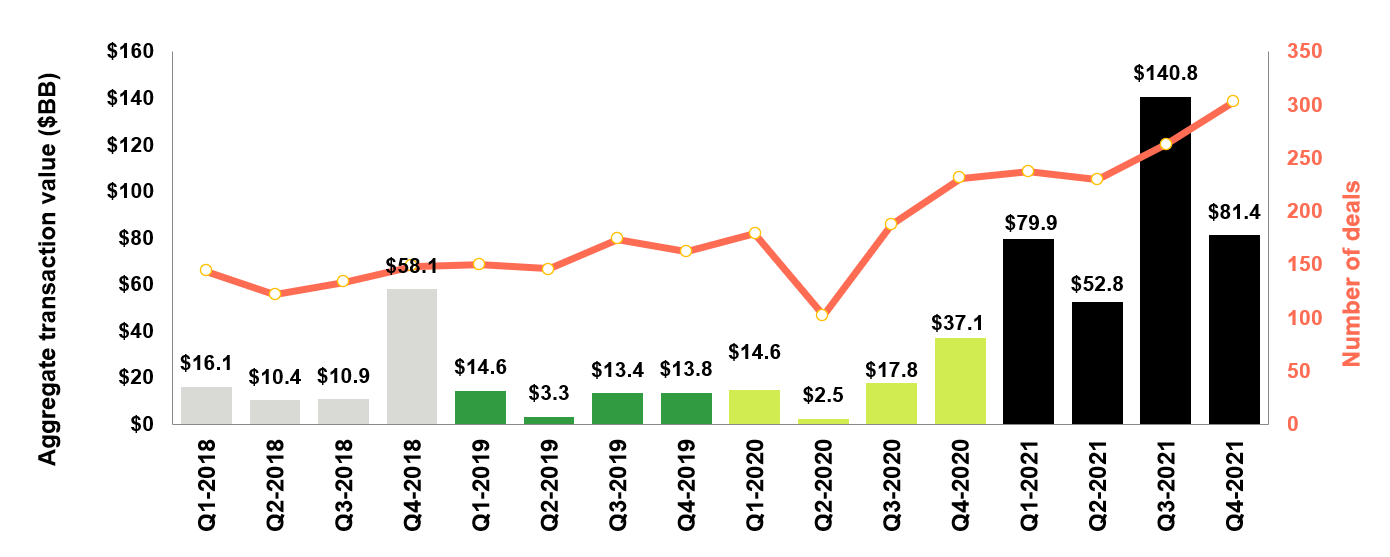

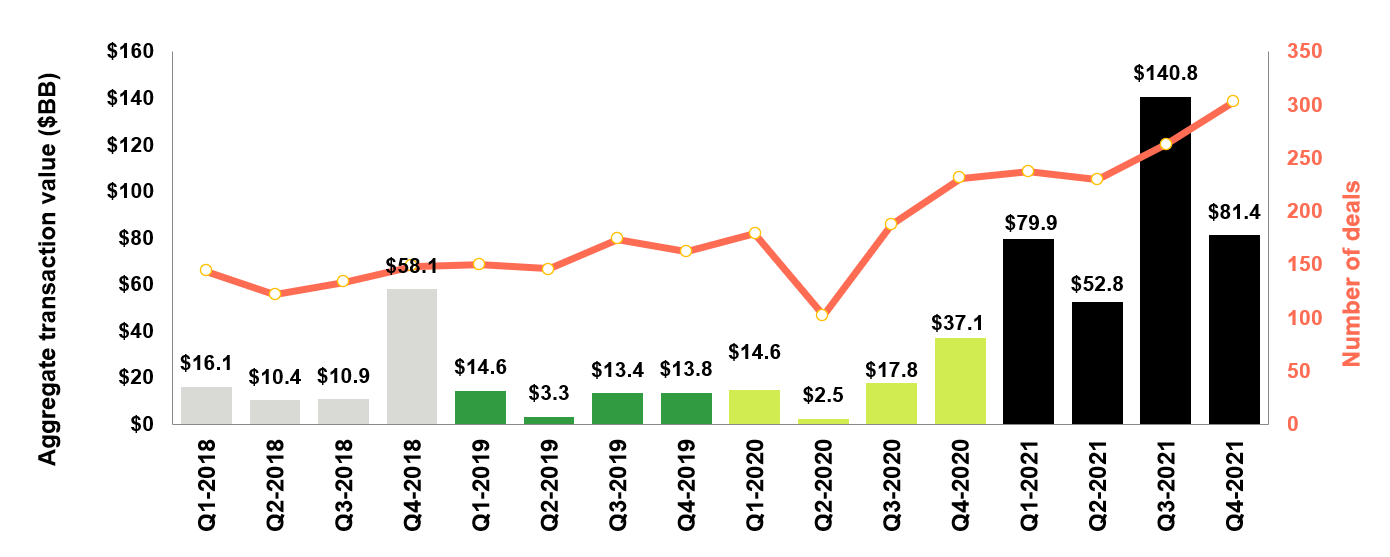

The Philadelphia and Central Pennsylvania region continued to thrive in H2 2021, surpassing several significant performance indicators from the year prior. With 566 transactions closing in the market during the second half of 2021, up from 468 closed transactions in the first half of the year, the region is benefitting from a greatly anticipated market resurgence. Further indications of a recovery: The market witnessed a staggering 35.1% increase in closed transactions from the 419 closed transactions in H2 2020.

Notably, the M&A activity in the Philadelphia and Central Pennsylvania region also maintained its steady rise in deal volumes from the first half of the year into its third and fourth quarters. As M&A markets continued to open up and debt financing remained readily available at historically low rates, the region mirrored the trajectory of the U.S.’s overall M&A markets.

With new benchmarks being achieved in back-to-back years, only time will tell if this market activity will continue into 2022 and beyond.

Philadelphia & Central Pennsylvania regional market M&A activity

Source: S&P Capital IQ; (December 2021)