Inflation and the labor market – interconnected and significant pressures facing school districts

School districts are facing historic pressures related to their current and future expenditures – both in terms of inflationary increases related to commodities and market demand related to compensation for all staff. These cost pressures are further complicated by the looming expiration of the Elementary and Secondary School Emergency Relief (ESSER) funds provided to assist with the impacts of the pandemic. While the funds are certainly welcome relief, new programs and staff added with ESSER funds may place even more budgetary pressures on districts as the impacts of inflation and increased labor costs continue to grow.

Price increase impacts

Inflationary increases in commodity prices are impacting budgets across a number of areas from fuel to food and construction materials. With food prices continuing to increase, districts will need to keep a close watch on their food service budgets, particularly with the end of the universal free breakfast and lunch that was enacted during the pandemic. Districts may have to re-examine how meals are priced and strike a balance with passing along costs versus trying to absorb costs to the best extent possible. Fuel costs will also be a key area of focus for the upcoming school year. Diesel prices are at historic highs, which may place significant pressures on districts with larger fleets and extended routes. Additionally, construction and maintenance projects may be facing two-fold pressures with increases in the cost of building materials and labor costs. Districts need to be particularly aware of increased construction costs if there is potential to impact completion of project and project budget – regardless of whether the project was debt financed or paid from cash on hand.

Key factors to understand in relation to your district’s exposure to inflation include:

- Examine contracts related to possible pain points. In particular, pay attention to building maintenance, nutrition and transportation to understand how inflationary costs may be passed on to the district (or not).

- Analyze potential impact of the end of universal free breakfast and lunch. Any realized benefits of free meals for all students – is it easier to administer? Reduction of stigma associated with providing free meals to some students?

- Consider plans to reduce inflationary impacts exposure such as switching bus fleet to an alternative energy source, etc.

- Proactively engage with contractors on construction projects to examine pressures related to material and labor costs. Examine pre-purchasing of certain materials, if possible, to help control costs if further increases are likely.

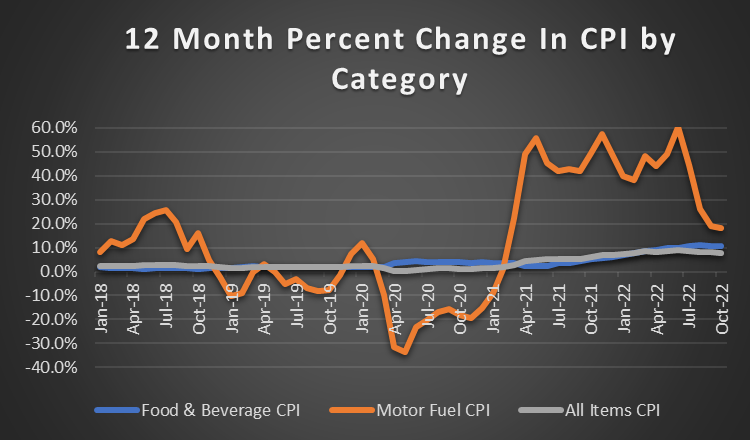

Consumer Price Index (CPI) data highlights the pressures districts (and for that matter consumers) have experienced beginning in 2022 – particularly for motor fuel (including diesel). The following graph shows the year over year monthly percentage change for CPI for motor fuel, food and beverages and all items (i.e., total CPI) since 2018:

As the chart shows, the CPI for motor fuel has increased exponentially since the start of 2021. Food and beverage CPI while not nearly as high, have seen steady increases, particularly in the last year – but tracking much closer to increases in total CPI. Data shown is through October 2022 – which reflects the more recent stabilization of prices that began in July 2022. Efforts to curb inflation continue, but concerns regarding pressures related to higher prices remain apparent. (Source: US Bureau of Labor Statistics CPI)

The Producer Price Index (PPI) is another key metric to keep a close watch on as this is more of a leading indicator of possible inflationary impacts as opposed to the lagging nature of CPI. PPI focuses on price changes producers of goods, services and construction are facing as opposed to those of the purchaser. The most recent PPI data is mixed with small decreases in July and August – and more recently a modest increase in September as compared to the prior month. PPI remains relatively high in comparison to September 2021, with prices for producers 8.5% higher in September 2022. Given the relatively higher prices facing producers, districts and other purchasers should be prepared and budget for continued higher prices, at least for the near term. (Source: US Bureau of Labor Statistics PPI)

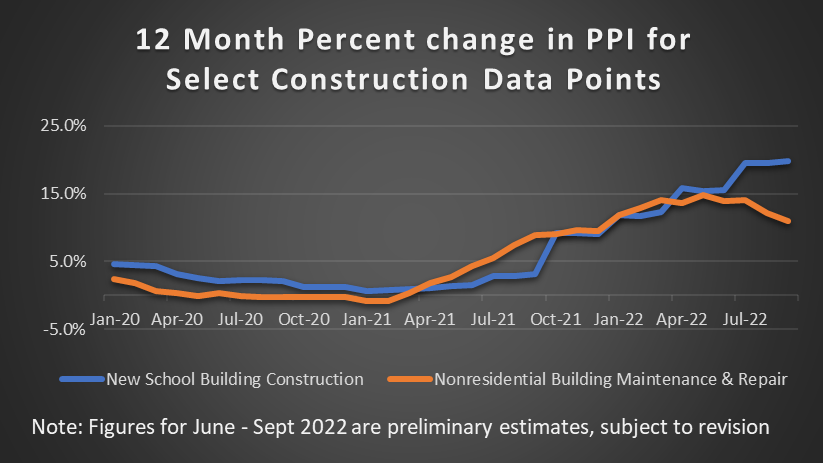

As mentioned above, construction related costs are an area of potential concern with the magnitude of the construction/capital improvement related expenses and also if debt financing is used. The following shows the PPI year over year percent change for the construction of new school buildings and nonresidential building maintenance and repair.

As with PPI and CPI overall, construction cost prices have seen some recent flattening. Even with this flattening, the September preliminary PPI for new school building construction is 19.8% higher as compared to a year prior. While moderating compared to growth seen in the beginning of 2022, price increases remain at some of the highest levels since prior to the great recession of 2008. For nonresidential building maintenance and repair, PPI has not seen the same level of increases as new school construction. Beginning in June 2022, these figures have also seen decreases in the year over year percent change. However, prices still remain high, with the preliminary figure for September 2022 being 11% higher than August 2021.

Broader pandemic and economic related pressures are also impacting school districts’ largest operating expenses – salary and wages for staff. With the shift in the post-pandemic labor force, school districts are finding themselves in increased competition for prospective employees across all needed areas of staff. Competition seemingly continues to increase between neighboring school districts to offer competitive compensation packages to attract and retain the most highly qualified staff. This is further compounded by districts needing to compete more than ever before with the private sector for applicants and the ability of private sector companies to generally be more flexible in being able to offer higher/better compensation.

Competition for qualified applicants is just part of the pressure. Districts also face pressure related to demand or likely demand for wage increases from current staff to offset the pressures of inflation that their employees are facing as a part of their personal budgets in their day-to-day life. This could be further compounded if any wage increases were offered during the height of the pandemic and if those increases were one-time or recurring and how those increases may have been paid for.

Key considerations for districts in facing the need to increase salary and wages include:

- What is your district's compensation philosophy? Does your district want to lead, lag or be average with peer districts/organizations?

- How do your salary and wage schedules compare to neighboring districts? What type of increases have neighboring/peer districts offered recently?

- How have any recent increases been funded? Were reserves or ESSER funds used? Are these sustainable?

- What nearby businesses/employers do you most compete with for staff and what pay are they offering in comparison?

- How can you be more creative in offering short-term increases to offset inflation without locking in increases in long-term collective bargaining agreements?

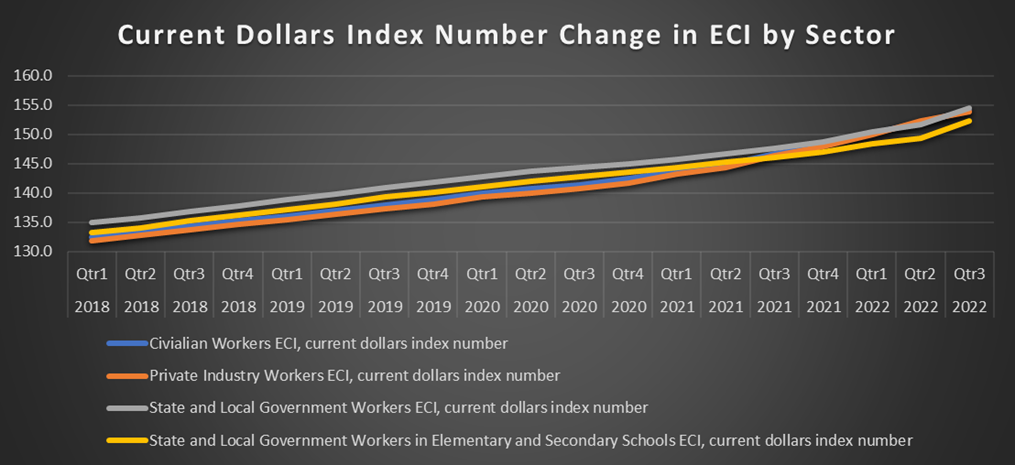

A tightening in total compensation between state and local governments and other employers is apparent from examining the Employment Cost Index (ECI) - a Principal Federal Economic Indicator calculated by the US Bureau of Labor Statistics (BLS). ECI tracks the cost of employees to employers between areas based on ownership (either civilian, private industry or state and local government) on a national basis for wages and benefits - including health insurance, retirement plans and paid time off. The following shows the index for the three major ownership areas tracked by the BLS with a further breakout of the index specifically for state and local government workers in elementary and secondary schools:

Since 2018, growth for civilian and private industry has outpaced state and local government, including elementary and secondary schools. The latest figures produced by the BLS show this trend continuing in June 2022, with a 12 month increase of 5.1% and 5.5% for civilian and private industry workers as compared to 3.4% for state and local government workers. **

The potential for an economic slowdown – driven in part by these pressures – continues to rumble across the news and Wall Street. While recessionary impacts on revenues are typically not immediately felt by municipal governments and school districts, entities will need to begin positioning themselves to deal with another added challenge. The potential for impacts to districts’ revenue streams are likely to further compound and require difficult decisions with the amount of other budgetary pressures facing districts.

Prepare now

Until recently, growth for civilian and private industry had outpaced that of state and local government over the last year, including elementary and secondary schools. While the ECI indices for the presented sectors remain tight, the index for state and local government workers in elementary and secondary schools continues to lag. (Source: US Bureau of Labor Statistics ECI - https://www.bls.gov/eci/)

The potential for an economic slowdown – driven in part by these pressures – continues to rumble across the news and Wall Street. While recessionary impacts on revenues are typically not immediately felt by municipal governments and school districts, entities will nonetheless need to begin positioning themselves to deal with another added challenge. And the potential for impacts to districts’ revenue streams are likely to further compound and require difficult decisions with the amount of other budgetary pressures facing districts.

All of these pressures will result in the need for an increased and better understanding above and beyond what is normal to know what are driving the district's costs and also making sure there is a sound understanding of what our top priorities are fresh for the district and what are the nice to have. Districts need to best prepare themselves for likely needed reductions or at this point even inevitable reductions in order to best balance their budgets as these pressures become more increasingly realized over the next several years. The pressures on the expense alone would necessitate the need for better analysis and conversations about projected expenses, with the further impacts of potential revenue impacts heightening the need for more robust forecasting of a district’s financial trajectory and using these forecasts as the basis for discussions with district’s board and senior leadership.

In addition, districts need to better understand their current expense structure and prioritize current programs and service offerings. Being able to distinguish between requirements and necessities versus ‘nice to haves’ may not make the decision to cut unless painful but will certainly facilitate better decision making. Forecasts and prioritization are keys to ensuring financial resiliency for districts, but this will need to be done with leadership-wide collaboration to ensure broad input and understanding for necessary actions.

Baker Tilly Municipal Advisors, LLC is a registered municipal advisor and controlled subsidiary of Baker Tilly Advisory Group, LP. Baker Tilly Advisory Group, LP and Baker Tilly US, LLP, trading as Baker Tilly, operate under an alternative practice structure and are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP is a licensed CPA firm and provides assurance services to its clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ©2024 Baker Tilly Municipal Advisors, LLC