Impact of COVID-19 on goodwill impairment analysis (ASC 350)

We continue to live in unprecedented times. The COVID-19 pandemic’s impact on society, the economy and businesses has been rapid, severe and complex. Earnings of companies in the S&P 500 index are expected to have fallen by 44% in the three months to June 2020, compared with last year.[1] Privately held companies, which generally are smaller, less diversified and have less ready access to capital than publicly traded companies are likely to fare no better. Financial markets have experienced extreme levels of volatility, with the S&P at one point having fallen nearly 30% from its February high. While the S&P subsequently rebounded sharply, segments of the market have seen varied degrees of recovery—e.g., restaurants, airlines and hospitality have been particularly hard hit, while segments of the tech sector and logistics companies have fared better. With the ultimate duration and depth of the impact to businesses uncertain, it is clear it has been and will continue to be drastic.

Among many critical repercussions of the pandemic, management teams and their auditors will need to consider implications for their assessments of the fair value of assets, particularly with respect to potential impairment to goodwill (ASC 350). While, with a few exceptions, it is difficult to think of a business that has not been affected by the pandemic, the extent of impact to each company must be specifically considered and analyzed.

Businesses are experiencing the impact to revenue and profitability in real time. But, even after the pandemic has subsided, its long-term impacts are likely to be profound. There is a very real possibility that consumers, businesses and governments—weighed down by lost income/earnings/tax revenue and increased debt burden, as well as the fear of a second wave of COVID-19—will spend at a reduced rate post-pandemic relative to the pre-pandemic era. This will result in lower growth trajectory and profitability for businesses which will impact valuations.

Of course, the pandemic’s legacy to businesses will likely not be universally negative. Often cited is the acceleration of the virtualization of commercial and other activities, already underway pre-pandemic. This will almost certainly result in reduced costs and increased productivity for many businesses in the long run. Management teams and valuation analysts will need to carefully consider these impacts in their models, including thorough, rigorous stress testing. The unprecedented nature of the current environment likely requires additional attention be paid to downside scenarios, including the possibility of a “W-shaped” or “L-shaped” economic recovery and the specific implications such outcomes might have for the subject business.

Knee-jerk conclusions that inappropriately extrapolate negative current performance too deep into the future should be avoided, as should over-optimistic projection scenarios. At the end of the day, a sober analysis should be prepared based on a careful top-down and bottom-up assessment of the fundamentals of the industry and business to determine the proper valuation a market participant would attribute to the enterprise after thorough diligence. This valuation may be substantially different than the wild short-term swings in the financial markets this year might imply.

ASC 350

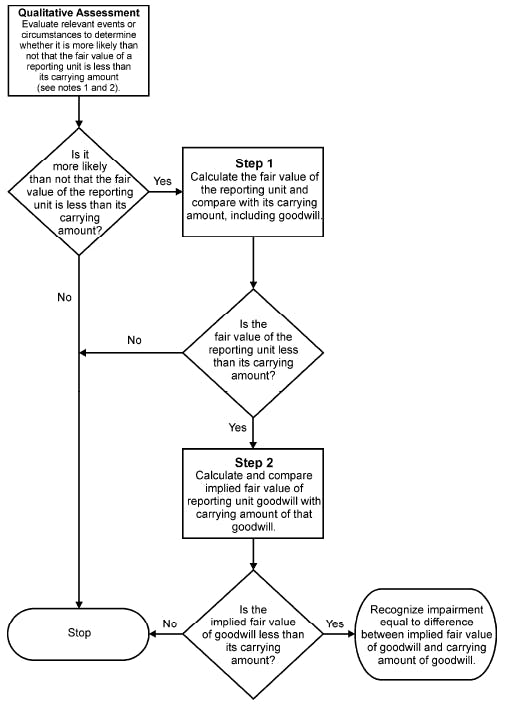

Under ASC 350, goodwill must be tested for impairment at least annually and more frequently if events or changes in circumstances indicate that it is more likely than not that the asset is impaired (see flow chart at bottom of this article). The continued impact of COVID-19 is likely to require public companies to consider if triggering events have occurred on a quarterly basis, particularly in industries hardest hit by the pandemic. Privately held companies that have chosen under the private company election (ASU 2014-02) to amortize goodwill are not required to test for impairment annually, but are required to test for impairment when a “triggering event” occurs indicating the fair value of the entity (or reporting unit) may be below its carrying amount. If it is determined a triggering event has occurred, an impairment test is required.

Examples of triggering events cited by ASC 350 are as follows:

- Macroeconomic conditions (e.g., deterioration in general economy)

- Industry and market considerations (e.g., deterioration in the environment in which the entity operates)

- Cost factors (e.g., increases in raw materials, labor)

- Overall financial performance (e.g., negative or declining cash flows)

- Other relevant entity-specific events (e.g., changes in management or key personnel)

- Events affecting a reporting unit (e.g., change in composition of net assets, expectation of disposing all or a portion of the reporting unit)

- For publicly traded companies, a sustained decrease in share price (considered both in absolute terms and relative to peers)

As described in this article, each of these factors has likely been impacted by the pandemic. For those businesses where the net impact has been negative, management teams and valuation analysts will need to carefully consider whether the impact is more likely than not to be sustained at depth and duration where impairment is warranted.

Assessing the implications for goodwill impairment testing

As discussed, the degree of impact of the pandemic to each business will be unique, requiring a careful, individualized assessment as to implications for goodwill impairment testing. Current financial and operational performance, industry and peer group market data and projection models will need to be rigorously analyzed in what will likely continue to be a rapidly evolving environment for the foreseeable future. Valuation analysis is always complex, but will take on an added degree of challenge and importance in these uncertain times.

Because goodwill impairment can have tangible and potentially far-reaching and critical impacts on a business, careful analysis is crucially important.

For more information on this topic, or to learn how Baker Tilly specialists can help with complex valuation engagements, contact our team.

[1] “America, Inc. braces for an earnings bloodbath”; The Economist; July 23, 2020.

Source: FASB ASU No. 2011-08

Companies that have chosen the private company election (ASU 2014-02) are required to carry out the analysis illustrated above only if a “triggering event” has occurred, as described in this article.