Greenhouse gas emissions 101: GHG reporting basics

Human activity has contributed to the dramatic increase in atmospheric carbon, a driving force of climate change. The industrial age has brought significant technological advances and efficiencies, but also increased reliance on greenhouse gas (GHG) emitting resources. Thus, businesses and industries are facing the new reality of managing growth while understanding and mitigating GHG emissions created by their core activities.

While the need for action is clear, defining those actions can be a significant challenge across various industries. This includes middle market organizations, who are now facing regulatory impacts and the need for increased transparency on climate-related matters.

When getting started, it’s critical to have a fundamental understanding of GHG reporting and how it affects your organization. Let’s break it down.

Define GHG reporting objectives and goals

When faced with a challenge, the first step is to understand the basic premise before plotting a course of action. First, companies must define their purpose, goals and objectives for GHG emission reporting. A thoughtful evaluation of how the reporting will be utilized requires consideration of future developments and forthcoming regulatory requirements. Additionally, companies need to understand the organizational and operational boundaries, including what is meant by scope 1, 2 and 3 reporting.

Many sectors accept the GHG protocol as the best practice methodology for GHG inventory. Developed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), the GHG protocol provides standards, tools and resources to align GHG accounting across five main principles: relevance, completeness, consistency, transparency and accuracy.

Establish organizational and operational boundaries for emissions reporting

Once the goals and objectives of this information have been evaluated, then organizational boundaries need to be identified. The GHG protocol guides companies to assess this boundary based on their organizational structure and financial and operational control considerations. This includes ownership structures such as joint ventures, split ownership or oversight.

Organizational boundaries

Establishing the organizational boundary sets the approach for emission reporting. It identifies how an organization will accurately capture their emissions inventory to reflect the full emissions impact. Identifying material emissions sources and their associated scope classification provides direction on what data needs to be collected.

According to the GHG protocol, two approaches can be used for reporting GHG emissions:

- Equity share approach: The equity share approach is utilized for companies with joint operations, split ownership, and, subsequently, a percentage of operations or control.

- Control approach: The control approach includes both the financial and operational approach. The financial approach provides a similar alignment to financial statement reporting in terms of the scope of reporting and aligns with international financial reporting standards. The operational control approach includes the reporting of emissions from all the operations controlled by the company.

Operational boundaries

Once the organizational boundaries have been identified, then operational boundaries can be set. An organization's operational boundary identifies the activities that provide the specific emission sources (i.e., mobile and stationary combustion, electricity, steam) that are included in the GHG reporting. The scopes determined for reporting (i.e., scope 1, 2 and 3) should align with the reporting goals and objectives of the company.

Understand scope 1, 2 and 3

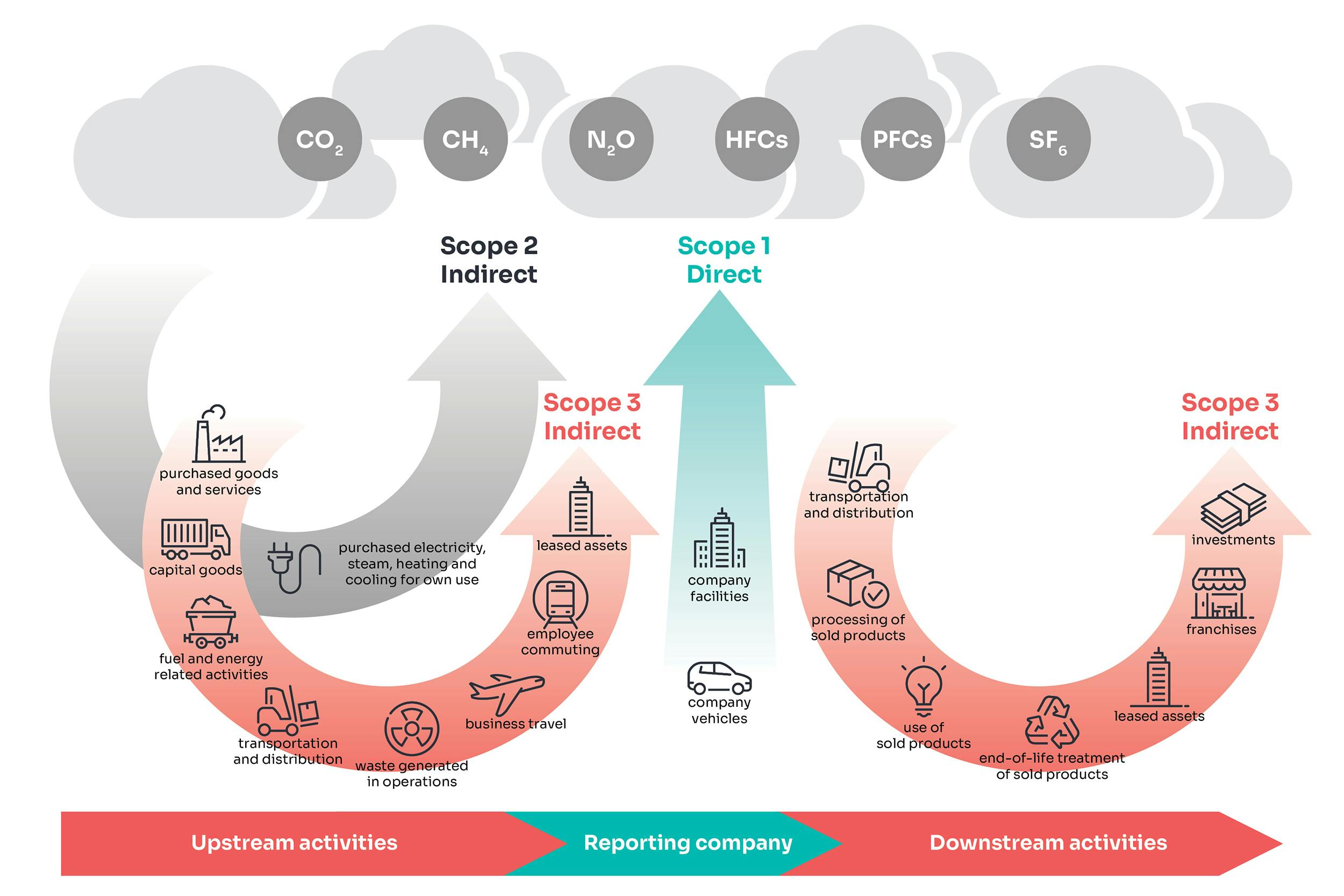

Scope 1, 2 and 3 are the GHG protocol method of categorizing GHG emission sources – in other words, a way of measuring an organization’s production and discharge of greenhouse gases. So, which types of GHG emissions fall under each of the three umbrellas?

- Scope 1 emissions are direct GHG emissions that an organization owns or controls directly. For instance, any emissions from inside an organization’s facilities (i.e., combustion from manufacturing processes or onsite generators, emissions from the use of refrigerants) or created by an organization’s vehicles (i.e., trucks, ships, leased cars etc.).

- Scope 2 involves GHG emissions that an organization causes indirectly. This includes the electricity, steam, heating and cooling systems, and other power-generating platforms that the organization uses (i.e., electricity purchased from the grid).

- Scope 3 includes indirect emissions incurred on behalf of the organization by services rendered by a 3rd party. In other words, these are emissions that an organization is indirectly responsible for up and down its value chain, such as emissions created by its customers and suppliers (i.e., employee commuting, air travel, upstream transportation and distribution).

Diagram from GHG Protocol: Scope 1, 2, and 3 Emissions; this diagram is widely published and used by a variety of government and investor publications regarding ESG.

Once you understand the organizational boundaries and applicable reporting scopes – and you know which are aligned with your reporting objectives and goals – then you can begin to prepare for the GHG reporting process efficiently.

The need for middle market companies to have a firm grasp on their emissions profile is growing. Today’s regulations centered on climate transparency are requiring public and, in some cases, private companies to report climate impacts across their value chain. The initial manifestation of the climate transparency need across the middle market is in scope 1 and 2 emissions. By focusing on preparation in the near term, these organizations will meet requirements that are becoming more and more prevalent across RFP’s, private equity financing, grant applications and contractual obligations.

Take it one step at a time

The GHG reporting process may seem daunting – but it doesn’t have to be. Most middle market companies will start with narrow organizational and operational boundaries based on what information they have readily available. From there, the goal shifts to expand those reporting boundaries as the organization’s GHG inventory – and the literacy surrounding that inventory – continues to grow.

Your organization can strategically prepare by establishing an inventory management plan (IMP). An IMP is a governing document that outlines what is being measured, how it is being measured and who is responsible for the collation and integrity of the data. An IMP will help to deliver:

- A basic understanding of what GHG inventories are and why your organization needs them

- Emission source definition

- GHG Protocol aligned data collection and calculation methodology

- Creation of the initial GHG inventory for your organization

GHG inventory transparency enables emissions reduction initiatives. which are often linked to considerable reductions in operating costs.

No matter where you are on your ESG and sustainability journey, understanding the basic concepts and ramifications surrounding GHG reporting is critical. Middle market companies who wish to grow and remain competitive should take action now.

Take it one step at a time. We’ll meet you where you are. Get started today.

Fast approaching climate-related risk and reporting requirements impact the middle market

Middle market organizations may unknowingly face profitability and compliance issues with looming climate-related risk and reporting requirements. Learn more about the impact of proposed climate-related disclosure and what the middle market is doing today.

How mandatory regulations are shifting the global ESG and sustainability reporting landscape

The global ESG and sustainability reporting landscape is shifting from voluntary reporting to mandatory disclosure. The most impactful of these regulations include the SEC’s proposed climate-related disclosure rule, CSRD, SFDR and the proposed FAR amendment.