GASB 89: How capitalized interest changes impact utility rate cost recovery

GASB 89 requires that utilities that follow GASB standards expense construction period interest costs

The Governmental Accounting Standards Board (GASB) recently issued Statement No. 89, Accounting for Interest Cost Incurred Before the End of a Construction Period, which is effective for reporting periods beginning after Dec. 15, 2019. GASB 89 states, “In financial statements prepared using the economic resources measurement focus, interest cost incurred before the end of a construction period should be recognized as an expense in the period in which the cost is incurred. These interest costs should not be capitalized as part of the historical cost of a capital asset.”

The requirements of GASB 89 may not always meet the business model of public sector utilities for rate recovery. Utilities finance long-term infrastructure projects with long-term debt. Capitalizing construction period interest is a common industry practice. The logical leap: incurring interest costs stems from the need to borrow for projects, so the interest on those borrowings should be part of the construction project and utilities include these costs in their rates over the life of the related assets. Also, it is common for regulated utilities to capitalize their internal cost of capital when using internal funds for construction activities, utilizing the standards under GASB Statement No. 62, Regulated Operations.

During the exposure draft phase of finalizing GASB 89, the GASB Board heard concerns and has made provisions for the situations where construction period interest is recovered in utility rates.

GASB exceptions for expensing construction period interest

The GASB added language in GASB 89 that the provisions of regulatory accounting still apply under the new GASB 89 standard.1 The board stated, “If the criteria for regulated operations are met and the entity has elected to apply the related provisions of GASB 62…the requirements…regarding capitalization of qualifying interest cost as a regulatory asset should remain applicable.” In the GASB Codification2, the GASB goes further stating, “the amounts capitalized for rate-making purposes as part of the cost of acquiring the assets should be capitalized as a regulatory asset for financial reporting purposes.”

This means although interest can be capitalized, it will not be part of the asset’s cost. Instead it must be recorded as a separate regulatory asset.

A practical approach

These GASB 89 exceptions give public sector utilities the opportunity to continue to capitalize construction period interest. What’s a good approach? As most public sector utilities may not have implemented GASB 89, interpretations of a practical approach vary. Here is an example approach:

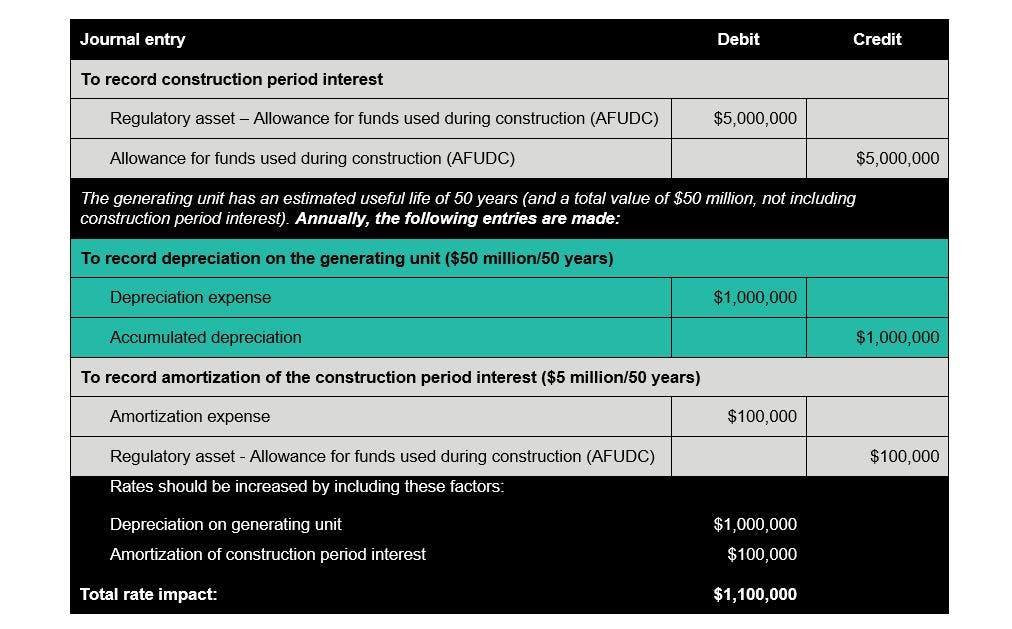

Utility A issued $50 million of revenue bonds to construct a small generating unit. It incurred $5 million of construction period interest it considers part of cost of the asset. It has implemented GASB 89. Utility A meets the criteria for a regulated operation and recovers this cost of construction period interest through customer rates over the life of the related asset. Utility A makes the following entries:

Why would a utility consider this?

Any time an exception to a GASB accounting standard is used, ask “why would we consider this?” The answer always circles back to how rates are collected from customers. In the above example, the utility collects depreciation from customers through the ratemaking process to provide funding for eventual replacement of the asset. The utility also includes a return on investment in infrastructure which is used to pay debt service. If construction period interest is excluded from rate recovery, sufficient funds for debt service payments or asset replacement will not be recovered through customer rates. The above example is one accounting method to align revenues with related debt service payments; other practical methods may exist.

For more information on this topic, or to learn how Baker Tilly energy and utility specialists can help, contact our team.

Sources

[1] GASB 89, page 11, B20

[2]The GASB Codification is the authoritative summary of GASB standards. The section referenced here is Section Re10.110 – Regulated Operations (after the GASB 89 amended language)

© 2024 Baker Tilly US, LLP