While the COVID-19 pandemic had an enormous impact on the deal-making environment, as economies continue to move into a recovery phase, deal-making has bounced back in a significant way. At a recent Baker Tilly webinar, Mike Milani, principal, Baker Tilly Capital, LLC, noted that “in the pandemic deal-making environment, what you're seeing is motivated buyers and motivated sellers. Many people have adapted a post-COVID growth outlook where many businesses for sale right now have been in recovery or are fully recovered.”

Third-quarter 2021 merger and acquisition (M&A) transactions broke several records, Milani noted, including global M&A reaching an all-time peak of $1.52 trillion. In the U.S., M&A activity was up 32% in Q3 for a total of $581 billion.

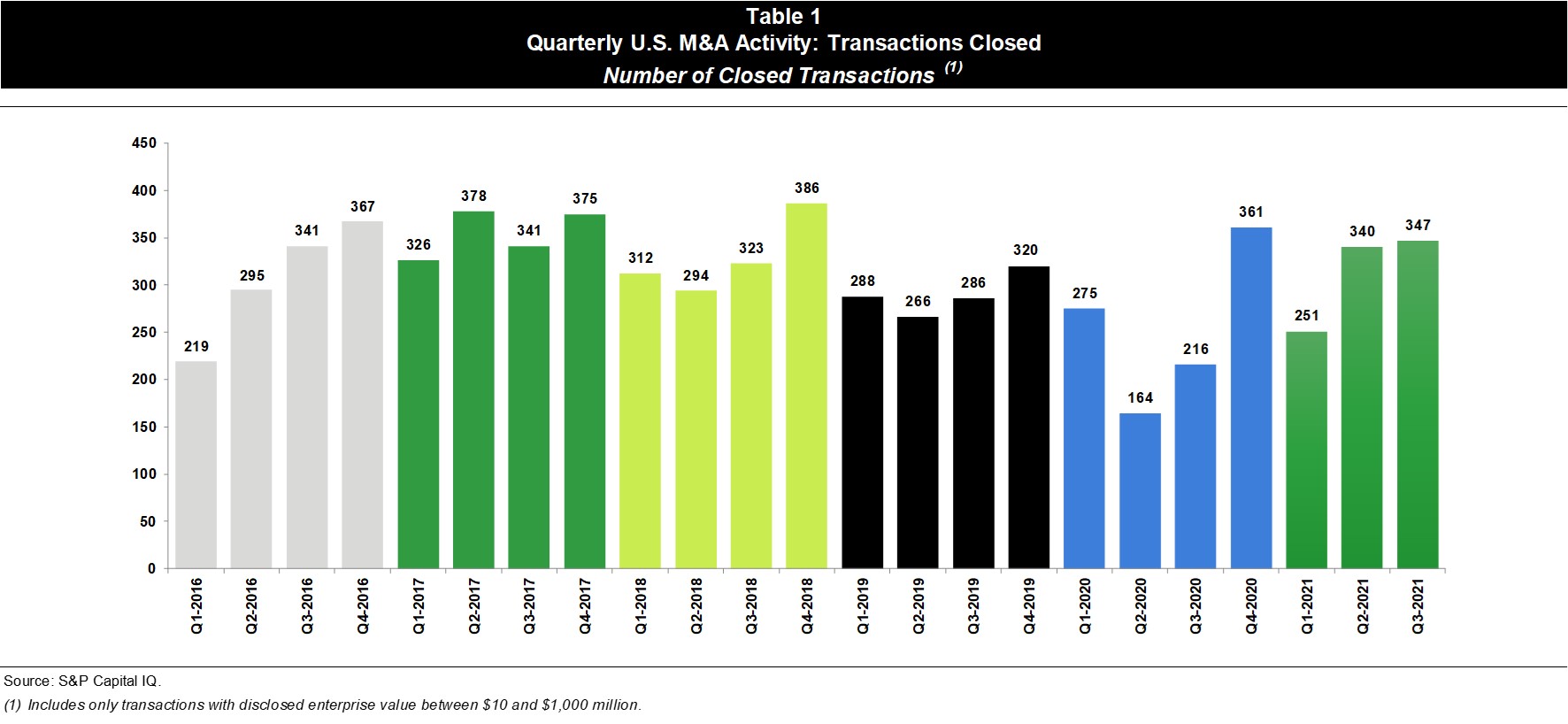

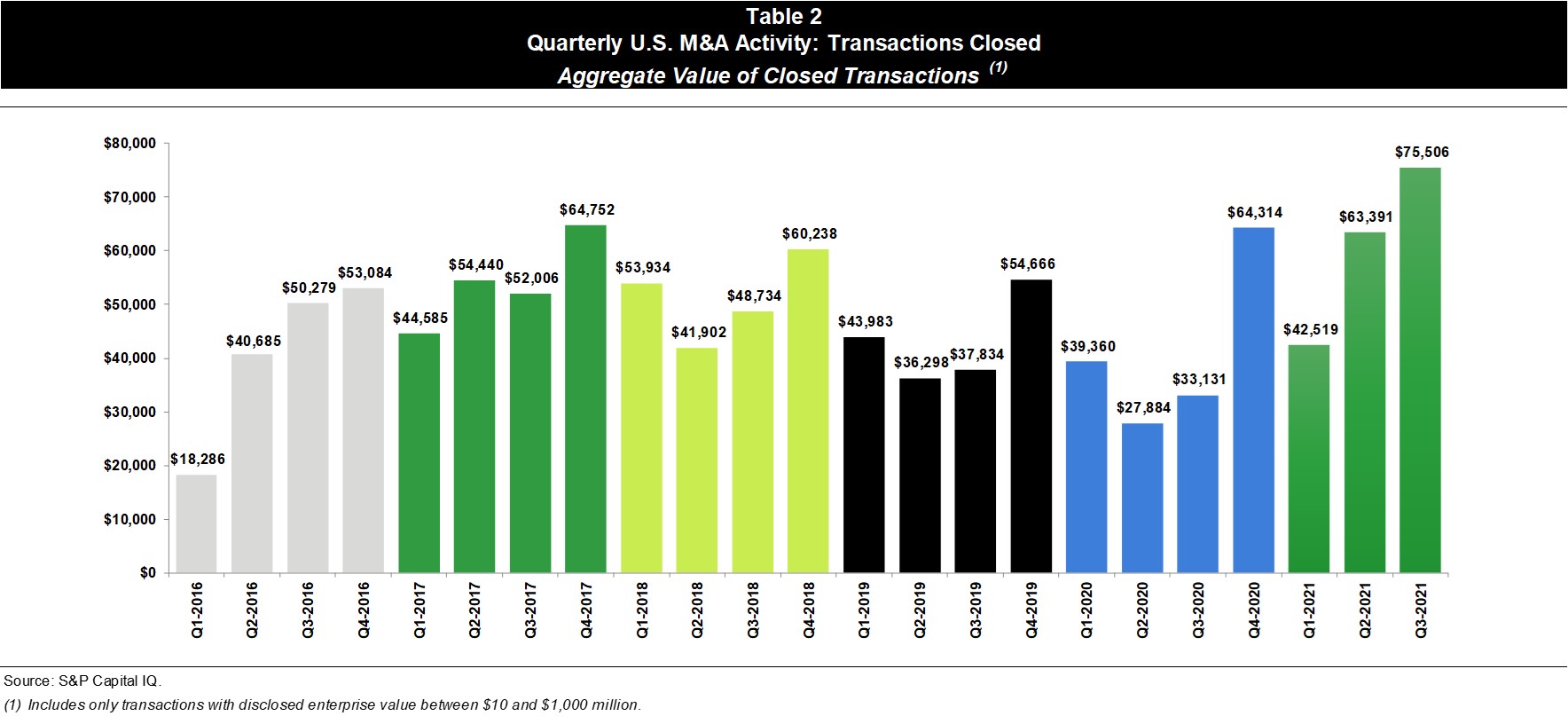

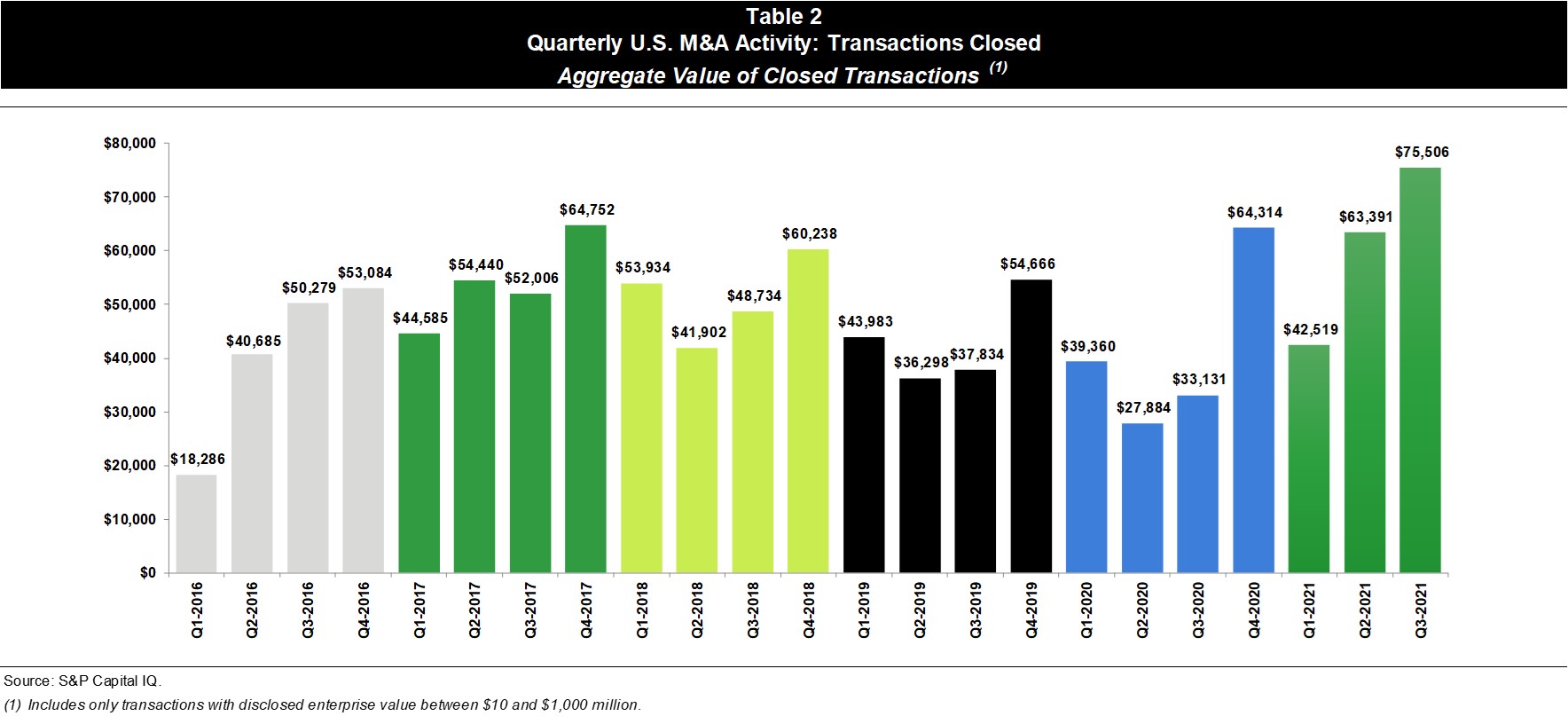

Over the last five-plus years, M&A has generally been steady – both in terms of the number of transactions and the number of dollars – as depicted in the charts below. Following some ugly pandemic-driven numbers in Q2 and Q3 of 2020, transaction activity began to bounce back in Q4 of last year, and the numbers in Q2 and Q3 of this year are in line with typical years, Milani said. Additionally, this year’s Q4 figures are projected to be quite robust, as well.

“As I look into my little crystal ball,” Milani said, “my guess is that the fourth quarter is going to be much stronger than the first three quarters.”

“You have seen a number of companies come to market in 2021 that were thinking of going to market in 2020 but decided not to put themselves up for sale, just to get past the pandemic and some of the issues that people saw during that recovery period,” Milani said.

Factors behind the continued resurgence of M&A activity include:

- Post-COVID outlook: Many businesses are recovering from the impact of COVID-19, and buyers/sellers are beginning to feel optimistic about the future

- Possible capital and estate tax changes: Capital gains taxes might increase, and valuations continue to be quite high, both for public and private companies

- Valuation opportunity for sellers: EBITDA multiples are strong at the moment, which in turn has led to strong valuations for companies looking to sell

- Acquisitive private equity and strategic buyers drive M&A demand: There was not a lot of M&A activity in 2020 and early in 2021, relatively speaking, but now PE investors have money to spend – and interest in seeing what’s available

- Liquidity: The combination of cash on corporate balance sheets, a low interest rate lending environment and private equity cash are all contributing to the liquidity fueling deal-making

Examining the seller’s point of view

Brandon Zlupko, principal, Baker Tilly Advantage, noted that from the perspective of sellers, a contributing factor to pursue a deal is family business owners who no longer want to bear the effort and risks of their business and may not have a relative to whom they can pass the business. Additionally, many business owners are at or near retirement and are concerned about the potential for higher corporate, personal income, capital gains and dividend taxes. Some have determined that the after-tax proceeds from a sale are sufficient to fund their retirement.

“People are starting to ask the questions: ‘How much do I really need?’” Zlupko said. “’I’ve grown this business enough – can I be satisfied with that? Can I sell it off to family? Can I do other things now? Am I ready to move forward?’”

Also, sellers are influenced by two factors closely related to the pandemic. First, as Zlupko noted, some sellers are wary of the next “crisis” and how it could affect their companies, so they are looking to get out now rather than dealing with unexpected headaches in the future. And secondly, there is the “vacation home effect” – many business owners have spent significant time working remotely (either from their day-to-day homes or their vacation spots) and have enjoyed their flexible schedules and time with family and friends to the extent that their mindset surrounding how and where they want to live their life has changed completely.

As they work through these decisions, sellers are considering a variety of questions – many related directly to the pandemic – before diving into a potential transaction, including:

- Is the company demonstrating year-over-year improved operational and financial performance?

- Did the company demonstrate resilience through the pandemic and emerge as a better business?

- How does the company retain/attract/grow key talent?

- If the company did not sell in 2021, is it maintaining an exit planning mindset and waiting to go to market and sell next year?

Exit planning mindset

These questions are often part of the problem-solving process when it comes to exit planning. Zlupko highlighted several of the issues, including:

Family alignment

- The family enterprise does not share a vision for the future

- There is conflict related to the business ownership, leadership and/or performance

Individual family member changes

- The owner does not have a “third act” plan

- The next generation isn’t prepared to take over

- Estate plans are not current and do not reflect potential tax law changes

Ownership transition

- Sellers are considering transitioning ownership to family, management or an outside group

Value preservation and enhancement

- The business does not have a value creation plan

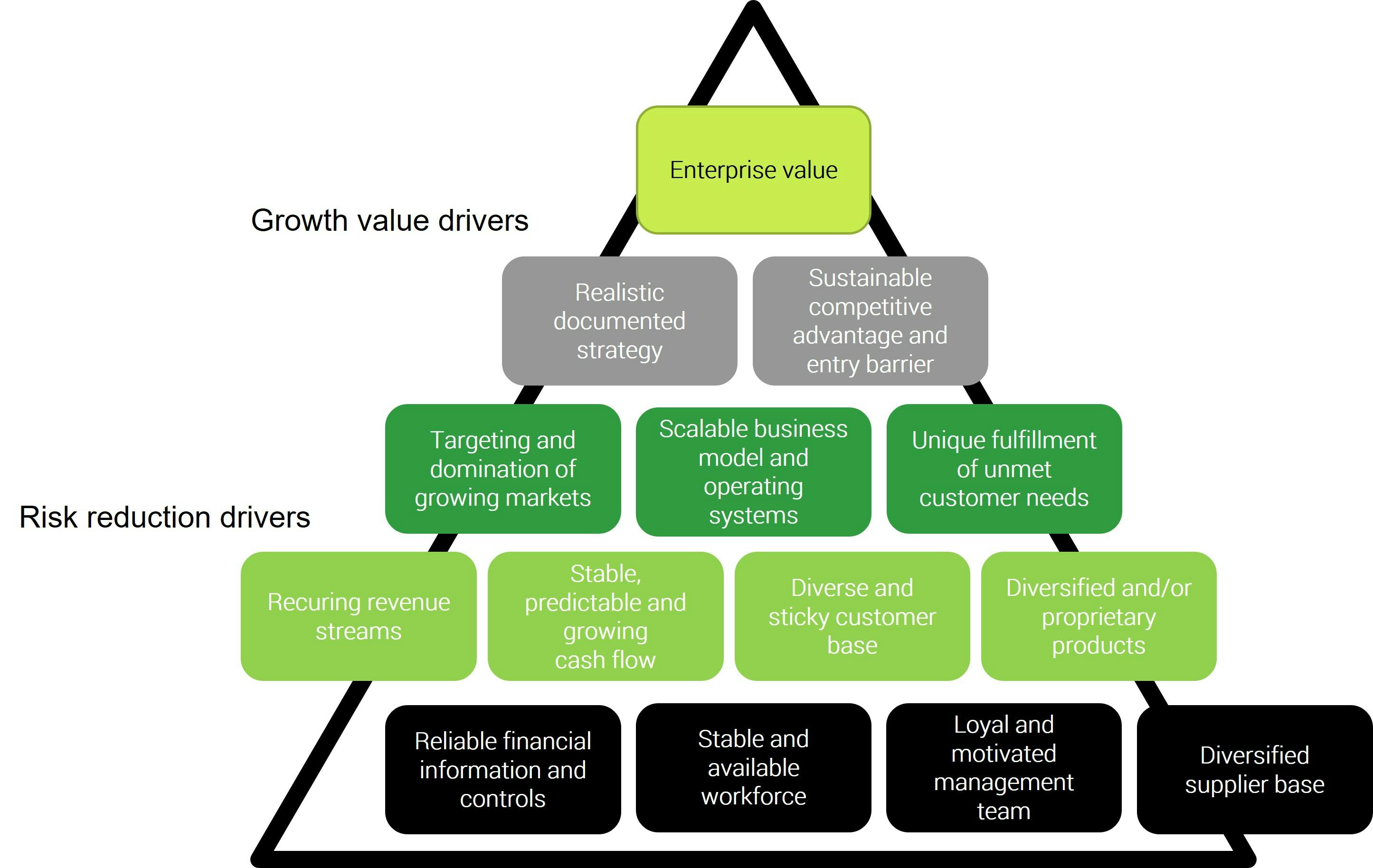

Once all these factors have been considered, the question is: Where do business owners go from here? Sellers need to understand how to structure the conversation and the strategy moving forward. In its simplest form, Zlupko highlighted a model for exit planning that can be divided into three categories:

- Family considerations: This comprises the family enterprise and strategy, the ownership transition options, and the considerations surrounding the next generation.

- Business considerations: What’s the strategic value creation plan? What are leaders doing to move the company forward? Is there a leadership succession plan? And how is enterprise valuation impacted?

- Personal considerations: This includes the estate plan, the wealth management plan and the “third act” and retirement plan, which all take into consideration the personal impact on individual family members.

These three dynamics can be viewed as a three-legged stool. “If any of those elements is out of alignment, then it’s not going to work. It’s not going to be stable,” Zlupko explained. “So, all of those things have to be considered – and in alignment – in order to be successful.”

The term “exit planning” often has negative connotations, Zlupko noted, but in reality it’s a sound business strategy that de-risks the negative impacts of the five Ds: death, disability, divorce, disagreement and distress. In the event that any of those elements force a business owner to sell, having a sound and proactive exit planning strategy can help them mitigate the impact of those Ds while still extracting maximum value from the sale of the business.